My investing experience was not on a flat road. Nor was it on a gently inclining path to slightly higher prices. In fact, my personal experience with long

stocks in the 1990’s led me to investigate choices for my IRA. It was distressing that I couldn’t benefit financially with stocks as their prices went

down. I learned that options were a trading style that could be used in an IRA, even those that demonstrate a profit in a market correction or Bear Market.

Apple Incorporated was introduced to the stock market in the late part of 1980. Steve Jobs and Steve Wozniak had developed the Apple Computer in the 1970’s

and worked at getting the news to the public. Having incorporated in 1977, they pushed forward in the building of and expanding the products for the

company. The equipment for music changed to the Apple iPod with iTunes the early 2000s. Other new products evolved after that.

In my search for options education, I watched the instructors at OptionsANIMAL talk about their Collar trades. I was most impressed with the Dynamic

Collar that was taught and done repeatedly by the coaches. The Collar trade consists of three instruments; long stock (LS), long put (LP) and short call

(SC.) The Dynamic Collar allows for some of these to be dropped temporarily, as long as the investor is diligent about inspecting the price chart at the

end of any day that the equity has been traded. The purpose of the price chart inspection is to see any evidence showing that the missing instruments are

needed again.

Apple Incorporated is one of the favorite equities at OptionsANIMAL.com It is one of the most innovative companies on Wall Street. They developed the

Macintosh computer, the iPod music player, the iPad, and iTunes. These products brought many companies to investigate the technology that bonds customers

to the Apple products. When AAPL (Apple Incorporated) broke out in 2003, it was valued near $20 per share. If I had wanted to benefit from the profitable

move, I would have purchased the long stock (LS) at $20, and sold it when I saw selling evidence at over $80 per share! (I always dream of these 400%

profits!) So, how does the AAPL collar work to protect my capital investment?

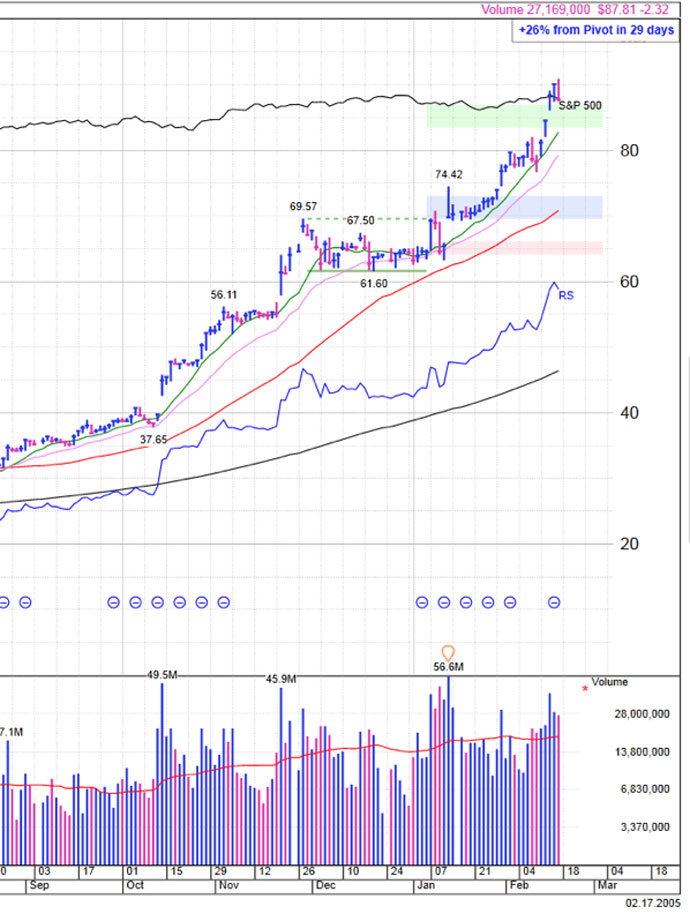

AAPL Daily Chart 2.17.05

As the stock price rose between September 2003 and its peak in February 2005, there were sell signals that would cause us to evaluate the possibility of

closing the LS position. What were they? Pullback to the 50 day SMA on March 9, 2005. Break of the 50 MA on April 1, 2005 (volume was low.) And, then high

volume break of the 50 MA with earnings on April 13th. AAPL had broken out from a Stage 2 base with full success. The price elevated more than

25% after the break-out, and then began its pullback. Between February 17, 2005 and August 12, 2005 the price never hit the high point again. A new base

was being built in preparation for another successful price rise of over 50%!

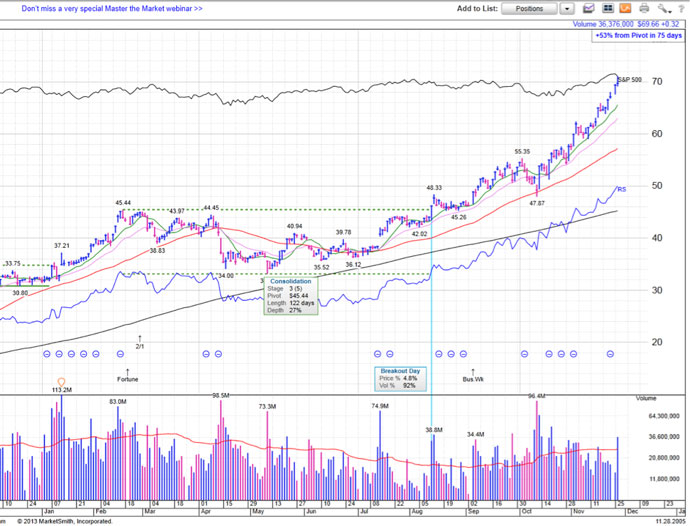

AAPL Daily Chart 11.20.05

How would a Dynamic Collar on Apple work?

The long stock was bought at $20 per share in December 2003.

Let’s look at the time that a 6 month base (consolidation) formed. Once the peak was hit at $45.44 in February 2005 there was drop on high volume under the

50 day SMA. (This was over $90.00 per share which was modified due to a 2/1 stock split on Feb.28th.) That was evidence that a LP needed to be

placed on AAPL. If the credit in a short call (SC) was big enough, it may have paid for the long put. On May 11, 2005, the stock price dropped to $33.11

and found many supporters who bought it back up to close at the high point for the day. That would have told me to close the LP for a profit, and perhaps

the SC, too. Both profits in these options instruments have lowered the cost basis in the long stock. The long stock may be held longer as it rose out of

the Stage 3 base for a miraculous success. Working through these technical indicators allows us to see the best choice for our equity positions. If we let

fear guide our decisions, we cannot win on the Dynamic Collar trade.

Emilu Bailes

OptionsANIMAL Instructor

Options Trading Resources

practice options trading * trading system * learn option trading * options trading classes * live investing workshops * options trading classes * online investing curriculum