What the heck was going on in Washington DC? Let’s not get political and pick sides here – because both side share some of the blame. This was a real

circus and an embarrassment around the world.

While this may have hurt our reputation, there really was no major threat to the economy. At least the market didn’t think so.

Last week on Wednesday, October 9 the S&P 500 gave us a doji candlestick. Candlestick charting is a type of technical analysis that looks at the open,

close, high, and low for each day (google it.) A doji is where the stock opens, trades higher and lower – or lower and higher – and then closes at

essentially the same opening price. A doji candlestick looks a little like a cross. These dojis are often associated with a reversal in trend.

Does that look like a trend change to you?

Historians who recall the Great Shutdown of 2013 and look at a stock chart of the S&P 500 would probably conclude that is it was

October 9 when the resolution occurred.

And that probably was the actual day that the Illuminati, Knights Templar, Freemasons, or Goldman Sachs decided to end the shenanigans in Washington –

while the three-ring circus went on for another week. The “official” resolution wasn’t inked by Congress until late on October 16. But, you wouldn’t know

it by looking at the market.

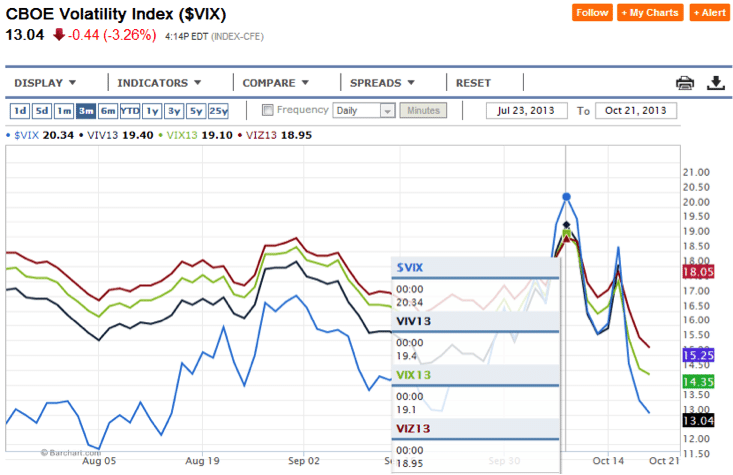

The conclusion that October 9 was the day that the real resolution was reached can be supported by looking at the VIX and the VIX futures. The VIX is the

CBOE Volatility Index. It’s a measure of estimated volatility in the future. It’s also known as the “Fear Index” because it tends to spike when there is

panic in the market. Normally, you will see the VIX and SPX moving in opposite directions.

On October 9, the VIX closed at 20.23 and the VIX futures contract for October (VIV13) which expires on October 15 closed lower at 19.40. (The November VIX

future (VIX13) closed at $19.10 and the December VIX future (VIZ13) closed at 18.95.) It is rare for the VIX futures to trade less than the VIX. Typically,

the VIX futures are in contango (where the future price is higher than the spot price.) There must have been some very assured traders – bearish on the VIX

– if they were selling VIX futures lower than spot VIX.

The logical explanation for the futures trading less than the spot VIX is that the market was confident that he VIX would be dropping. If you were

listening to any media outlet, on October 9, you didn’t hear anyone saying that the situation was near being resolved.

I am not saying that there was any sort of conspiracy or that politicians were in cahoots with Wall Street. After all, we are only talking about a few

hundred billion dollars that are traded in the stock market every day. But, the evidence shows that this thing was solved on October 9.

While the average trader may not have insight to the daily ongoing of the lobbyist on K Street, market data cannot be hidden from plain sight. It may take

a day or two for a trader to see the change in trend. But, to the savvy and educated trader, the signals are there.

Listening to one analyst in the media over the past week, I heard him say that the market was acting irrationally. That is impossible. The market is

inherently rational. Arguably, the market is perfectly rational. When the market behavior doesn’t fit your hypothesis, it’s not the market that is

irrational. It’s you.

Eric Hale

OptionsANIMAL Instructor

Options Trading Resources

practice options trading * trading system * learn option trading * options trading classes * live investing workshops * options trading classes * online investing curriculum