I have a reputation of being a perma-bull. I usually see the bright sight of things. It has worked very well for me for the past five years.

However, even this optimist sometimes sees the clouds on the horizon. Here are the five reasons why:

1) The January Barometer

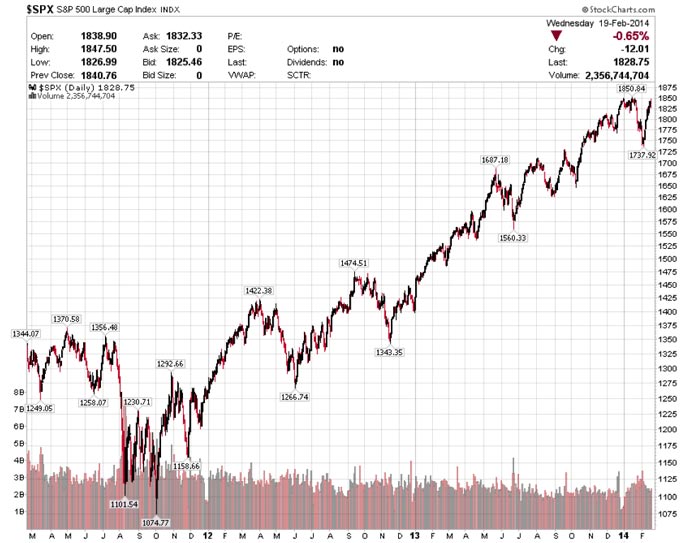

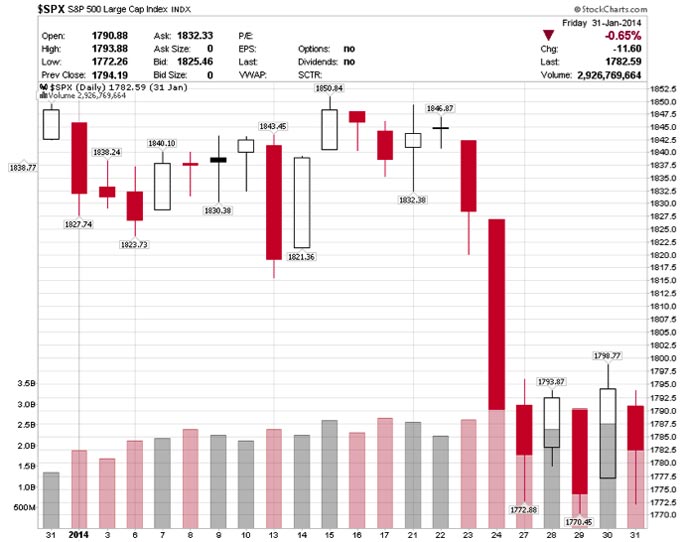

According to the Stock Trader’s Almanac 2014, the January Barometer states that as the S&P 500 goes in January, so goes the S&P 500 for the year.

Sounds a little “hocus-pocus,” I have to admit myself. In fact, it’s been a miss three out of the past four years. However, since 1950 it has been correct

86% of the time. In January 2014, the S&P 500 slipped -3.7%. That could be a warning.

2) Midterm Elections

Another anecdotal circumstance documented in the Stock Trader’s Almanac 2014 is the fact that nearly all bear market began in the two years after a

presidential election. The reasons for this could be coincidental. However, it has been well documented that changes in policy can have a significant

impact on the markets. When politicians change, policy does too. That can impact the market.

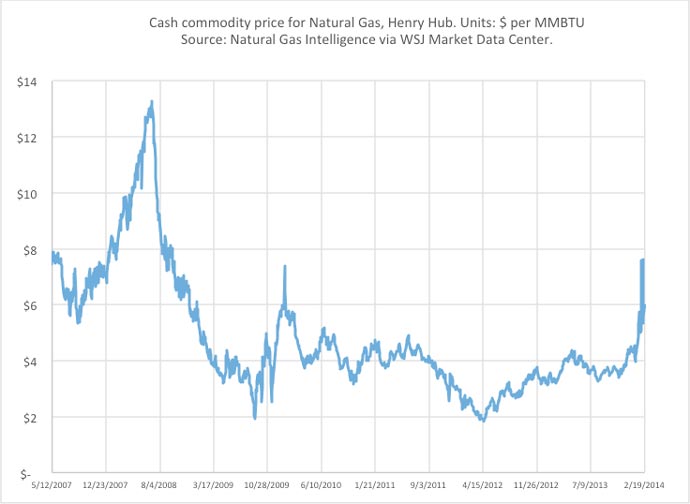

3) Natural Gas is Going Crazy

One of the factors driving this bull market is the fact that we have ultralow priced Natural Gas – or at least we used to have ultralow prices. With the

advent of fracking technology, producers have been able to extract significant deposits of natural gas that were previously unavailable. Natural gas

impacts nearly every part of our market. It’s used for cooking, heating, manufacturing, and electric generation. There seems to be the perception that

Natural Gas prices have continued to fall since fracking began on a large scale. The truth is that the price hit a bottom in April 2012, and it has been

creeping higher since. But the price had still been low, until very recently. In the past few weeks we have seen gas spike by almost double in price. While

this spike was due to supply and demand issue and futures are pricing in lower prices just a few months out, the price of gas is still higher today and

probably will be for a little while. That means people and business will spend more to heat and eat. Manufacturers will pay more to make their products.

Electricity prices will increase impacting everyone. It is not a cataclysm. However, it’s going to have an impact. Some people will have less in their

checkbook to buy Big Macs. Business will report earnings for this quarter with slightly lower profits.

4) The Fed

The Federal Reserve cannot continue the monetary easing policy forever. We saw evidence of some dissent among the committee in the most recent FOMC

minutes. The market clearly took a jolt from the comments. We all know that this “free money” gravy train has to end, sooner or later. With a new change in

leadership of the FOMC, no one can really knows.

5) The Soros Put

Personally, I am not a big fan of jumping on other people’s trades. I always preach that you should own your own trades. However, that doesn’t mean that I

don’t sit up and take notice when a prominent investor like George Soros places a $1.3 billion bearish bet on the market. The data was revealed in his most

recent 13F filing (Google it to learn more.) I am not advising that anyone goes out and blindly buys put. However, it is certainly worth noting when a

whale makes a splash.

What is a trader to do? Do you batten down the hatches and sell everything. It’s not what I am doing. In fact, my portfolio is currently biased bullishly.

However, what I am doing is ensuring that my secondary exits are well defined. (What’s a “secondary exit?” That’s what you do when your trade goes against

you. It is a fact: some of your trades will go the wrong why. So, prepare for that ahead of time.)

While I am a perennially optimistic perma-bull, I do look on the horizon for that storm. Because it’s not a matter of “if” a storm is coming. The question

is “when?”

Eric

OptionsANIMAL Instructor

Options Trading Resources

practice options trading * trading system * learn option trading * options trading classes * live investing workshops * options trading classes * online investing curriculum