The best time to trade a straddle or strangle is probably not when you think it is the best time to trade a straddle or strangle.

Straddles (long call and long put at the same strike) and strangles (long call and long put at different strikes) are trades that take advantage of explosive moves in an equity. The problem with these trades is that they become expensive before events that can move a stock, e.g., earnings, product announcements, FDA rulings, etc.

Consider the January 23, 2012 earnings report on Apple (AAPL.) Most people expect a big move when Apple announces earnings. On January 23, 2012 – the day that they announce their fiscal Q1 results – Apple closed at $420.41. After the market closed, Tim Cook and the team presented fantastic results. Apple opened the next day at $454.44 and closed at $446.66. That is a huge move by any standard.

Traders use the straddle or strangle strategy when they expect a big move – but they do not know direction of the move. Generally speaking, long call makes money when the stock goes up and long puts makes money when the stock goes down. If you buy both a call and a put, you don’t care which way it goes – only that it move a lot.

For this most recent earnings cycle on Apple, just before the market closed, you could have bought the at-the-money straddle using the weekly options at the 425 strike for $23.18. However, even though Apple had big move, you would have found that the straddle was worth $22.78. That is a $0.40 loss on the next day’s close.

This is a tough lesson for novice options investors. The reason that the trade was not profitable is because of two reasons: 1) the stock didn’t move enough and 2) the implied volatility dropped.

Because everyone thinks that Apple is going to have big move, option prices become expensive. We see this in the rise in the options’ implied volatility. Implied volatility can been a little confusing to traders who only trade equities like stocks and ETFs. But, the information that you can garner from implied volatility is like a crystal ball. It tells you what the market is expecting the underlying equity to do. High implied volatility means that the market expects that there is a potential for big movement in the future. It doesn’t tell you if the stock is going to go up or down. It just tells you that the market thinks it’s going one way or the other. And when implied volatility is low, that means the market expects little movement.

The market is not always right. Sometime options are overpriced, sometimes they are cheap.

When people talk about “volatility” usually they are referring to is the historic volatility. That is the volatility that did happen. It is backwards looking. Mathematically, the historic volatility is the standard deviation of the log change of the close-to-close price for that past 30 days. (Most often it is 30-days, but it could be other terms as well.) What implied volatility attempts to represent in the future historic volatility that is “implied” by the options pricing. Thus, implied volatility.

I like to tell people that the perfect way to measure implied volatility would be take a time-machine and travel forward 30-days in time and then look backwards and measure the historic volatility. It’s not a perfect analogy, but it makes the point.

You can also think of implied volatility’s impact on option pricing as something akin to the point-spread on a sporting game. When one team is expected to win by a landslide, you need them to win by a big margin to “cover the spread” and win your bet. Just as in our real example on Apple’s earnings demonstrated, if the market believes there’s going to be a big move, the options get expensive, and it’s hard to make money using a straddle or strangle. Apple gets a big point-spread around earnings.

The key to making money with a straddle or strangle is to buy it when the market does not expect to see a big move. I believe that there is such a setup emerging now in Berkshire Hathaway. Options are not traded on the BRK/A shares, but you can trade them on the “B” shares (BRK/B,) a.k.a., “Birky Bs.” The Birky Bs are non-voting shares which trade at about 1/1500 of the “Birky As.”

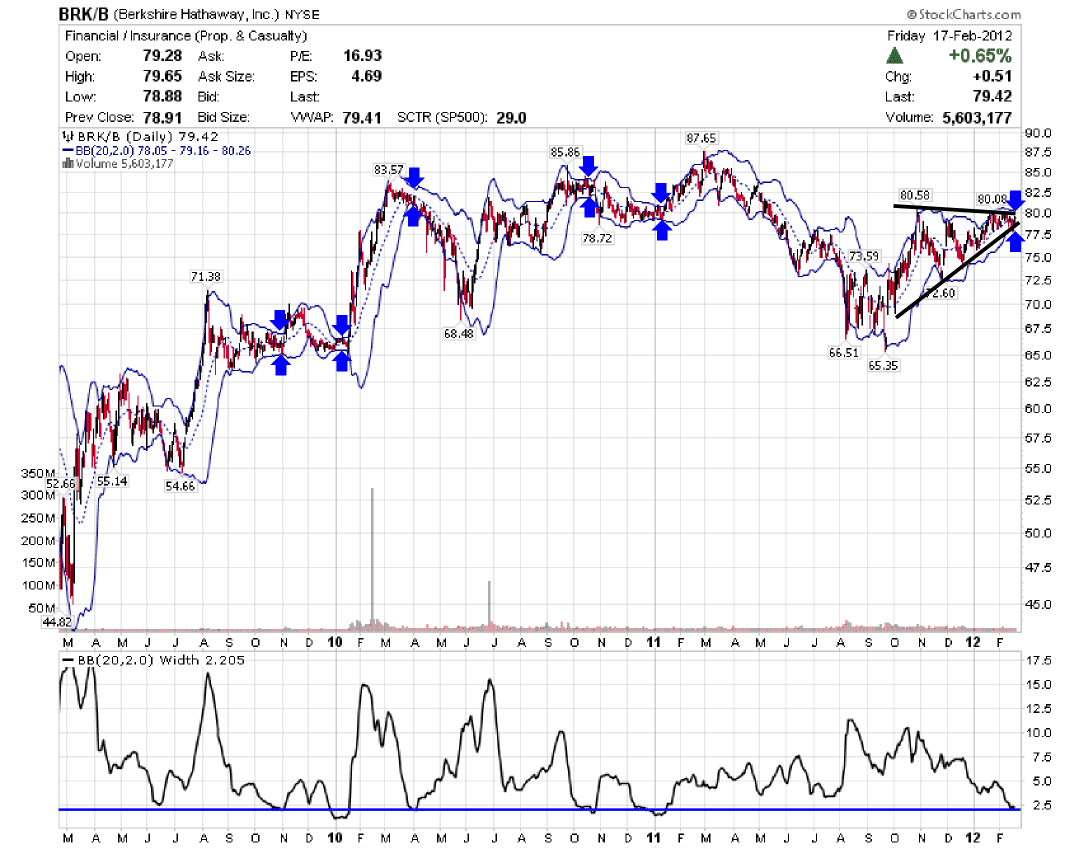

One way to consider historic volatility is to look at the Bollinger Bands. When the Bollinger Bands are close together, that means the stock’s history volatility is low. However, I consider these to be a contrarian indicator because they don’t usually stay close together for very long. I imagine a spring that is compressed between the two bands. That spring can only stay compressed for so long before it forces the bands to widen. That happens when the stock moves and causes historic volatility to increase.

Consider the 3-year chart below. The Bollinger Bands width has been at or below this range five times in the past three years. Each time after that, it has made a significant move.

Another technical indicator that is emerging is a pennant which has been forming for nearly five months. This is another technical indicator of a big move.

The technical indicators are pointing to some sort of pent-up big move in BRK/B. This is probably in anticipation of earnings date, which has not been announced but should be the week of February 27. What is interesting is that we have not seen a significant increase in implied volatility of the options. It has ticked up a little. But, most of the time Berkshire Hathaway does not usual have a huge run-up in implied volatility before earnings because it doesn’t usually have big gaps like some other equities.

If the technical indicators are correct at anticipating a big move, the markets have not priced that into the options. This could be a good setup for the straddle or strangle trade. My strategy is to buy a strangle and short puts and calls against it during this stagnant period. This strategy is a double diagonal and will make money in a stagnant trend with rising implied volatility. I will take the shorts off before earnings – thus, lowering my cost basis for the strangle – and then allow the strangle to make money. My primary exit will be to make 20% on this trade. (My secondary exit strategy is beyond the scope of this post.)

This strategy is not one for the uninitiated. There are a lot of moving parts. It is best to papertrade a new strategy like this until you have mastered it. Trades are like cabs, if you miss one, there will be another one coming along.

Eric Hale

OptionsANIMAL Instructor

Disclaimer: Any content presented by OptionsAnimal should not be considered as a recommendation to buy or sell a security. All information is intended for educational purposes only and in no way should be considered investment advice. Options involve risk and are not suitable for all investors. All rights and obligations of options instruments should be fully understood by individual investors before entering any trade. We are not recommending that you make any particular trade involving any particular security. Past performance does not guarantee future results, and a trading strategy that was successful in the past may not be in the future. Stock and options trading involves high risks and you can lose a significant amount of money

Options Trading Resources

option trading strategies * option trading course * online investing curriculum * options trading system * options trading professionals * beginner stock market investing