The OptionsANIMAL Blog

Content created by the OptionsANIMAL Instructors

Volatility is back! Perhaps that is the understatement of 2018 as we have watched global equity markets enter into- and rebound out of – correction territory in February. Just two weeks ago the market theme was FOMO – fear of missing out – and traders/investors couldn’t snap up shares of […]

Read MoreIf you really understood the VIX you would not trade it. On top of all the risks, which are frightening, it can be easily manipulated. You – and I mean YOU – can move the VIX with as little as $50. Only two kinds of people make money on the […]

Read MoreAs the S&P 500 continues to defy gravity at the start of 2018, investors are facing a bit of a dilemma. The “greed” monster on one shoulder wants to stay long the market and continue to benefit from potentially higher equity prices despite the fact that this index has not […]

Read MoreIt’s that time of year again where we reflect on our successes as well as our not-so-successfuls… For many of us, this means that we review the areas of our activities that are the most important to us individually. To some, getting back in shape was their biggest resolution, or […]

Read MoreOptionsANIMAL Raises Target Price for Apple (AAPL) to $190.75 and Expects Implied Volatility to Rise – Pleasant Grove, UT Despite technical warning signals, Apple Inc. (AAPL) shares still have some room for growth. Volatility behavior indicates there may be opportunities for options traders. OptionsANIMAL’s proprietary approach to trading begins by […]

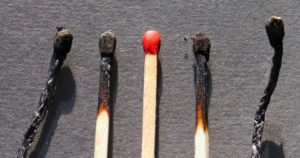

Read MoreCovered calls and short put have the same risk and reward at the onset. However, when the underlying stock price declines and these strategies start losing money, essential differences begin to emerge in the ability of the investor to manage the risk. Even though the risk is the same in […]

Read MoreIt’s hard not to recognize that the global equity markets have had a tremendously positive year in 2017. All sectors tracked by Sector SPDR’s have a positive return this year. There is one laggard for 2017 – the energy space. Let’s take a look to see if this could present […]

Read MoreOptions can be used to provide extra income, allow you to profit in every different market trend, and protect the money you already have. Options can be used to smooth out your returns, protect you in a down market and insure against the risk of catastrophic loss in your portfolio. […]

Read MoreAs I pen this blog, the S&P 500 had broken out to all-time highs and sustained that important technical event for several weeks. When investors begin to “peek under the hood” as to the reasons why the markets are at all time highs, question arise. The prices paid for shares […]

Read MoreSometimes the market seems to have a will of its own, acting deliberately to confound the largest number of people possible. Just when everyone expects the market to plummet, for example, after a monumental event like the Brexit, it stages a rally and breaks out to new all-time highs. As […]

Read MoreJoin 500,000+ Investors

Get the latest class invites delivered straight to your inbox.