OptionsANIMAL Raises Target Price for Apple (AAPL) to $190.75 and Expects Implied Volatility to Rise – Pleasant Grove, UT

Despite technical warning signals, Apple Inc. (AAPL) shares still have some room for growth. Volatility behavior indicates there may be opportunities for options traders.

OptionsANIMAL’s proprietary approach to trading begins by determining the direction. There three primary reasons for stock movement: Technical, Fundamental, & Sentimental. Each must be considered when evaluating the direction of a stock.

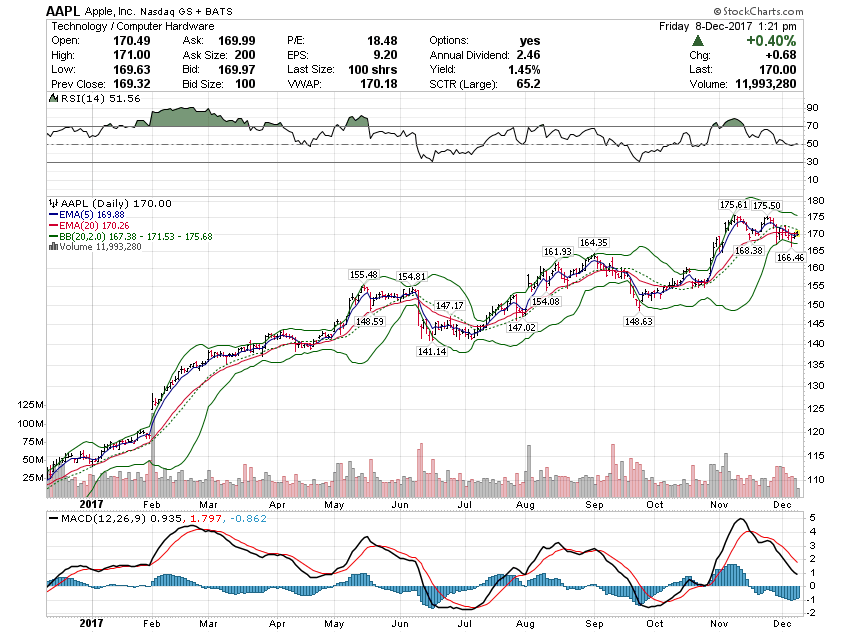

Technical analysis indicates that Apple is likely to trade sideways for the short-term. Over the past few weeks, there have been indications that the recent bullish trend has lost some steam. This can be seen by a crossover in the 5-day and 20-day exponential moving averages (EMA) which occurred at the beginning of December. About a week before that, there were signals from both the Moving Average Convergence and Divergence (MACD) and the Relative Strength Index (RSI). When the MACD crosses below the signal line, this is an indication that the stock is no longer bullish. When the RSI crosses below the 50-line, that is also indicative that the stock is no longer bullish. When the 5/20-day EMAs, MACD, and RSI signals occur together, it is typically considered a strong bearish signal. However, when they happen over a few weeks, that is considered a stagnant signal.

This behavior is not uncommon for Apple before earnings – more on that below.

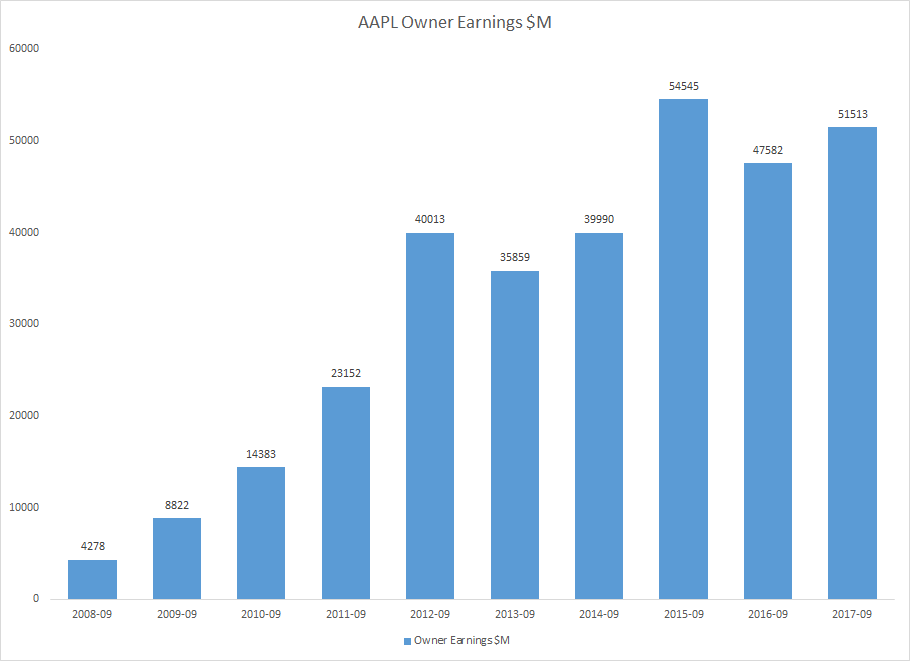

Apple is one of the best run companies in the world. Analysis of the fundamentals indicates that. Utilizing the same approach that lead Warren Buffett to add shares of Apple to the Berkshire Hathaway portfolio, it is clear that delivering shareholder value is of the utmost importance to Apple management. Many people ascribe product innovation and quality of Apple to Steve Jobs. He deserves full credit for that. However, his real legacy is the commitment growing shareholder value. Few executives can claim the same sort of performance.

Warren Buffett’s approach to valuing a company is no secret – he shares it with anyone who reads the Berkshire Hathaway annual reports. His approach is 1) determine the owner earnings of a company; 2) forecast the future growth; and 3) a discounted cash flow analysis of the present value.

Following is a chart of Apple’s owner earnings over the past ten years. The consistent growth over this period makes it one of the most impressive performances among the entire S&P 500. It is the reason why Buffett decided to add AAPL to the Berkshire Hathaway, and it has quickly grown to be the third largest holding in his portfolio.

OptionsANIMAL’s discounted cash flow analysis of these owner earnings places a per share value of $190.75.

While does not make sense to buy or sell an equity solely because someone else likes it, you can do far worse than following Warren Buffett’s trades.

The third leg of analysis is to consider the Sentimental indicators. OptionsANIMAL’s sentimental evaluation incorporates implied volatility, put/call ratio, and short interest. All of these agree with a rangebound trend until the next earnings cycle. While the earnings date has not been scheduled, it is typically around the last day of January. As of today, the sentimental analysis indicates that the next earnings event could push AAPL to $158 or $182. Because of that, we expect that the implied volatility will rise as the earnings event approaches.

Considering this analysis, we expect that AAPL stock will be stagnant to moderately bullish between now and the January 2018 earnings event. It is difficult to determine a stocks direction because there are always unseen events which are likely to impact a stock’s direction. However, it is not difficult to forecast where the implied volatility trend between now and the earnings event will head. For the past 40 Apple earnings implied volatility has increased as the event approaches. It is almost guaranteed that implied volatility will rise.

Additionally, considering the behavior of AAPL prior to earnings events, it is typically a period when AAPL’s historical volatility is low. AAPL tends not to have major upsets in trends prior to earnings. This is because earnings is so important to AAPL’s valuation, traders tend to wait until after the event to make decisions about buying or selling AAPL.

Note that we discussed two types of volatility: historical and implied. It is important that traders understand the important differences between these two.

Given a stagnant to bullish trend with rising implied volatility, traders would structure a trade that leverages a bullish trend – delta positive; the passing of time – theta positive; and rising implied volatility – vega positive. There are a few trades which would work well in this trend, but it seems particularly well-suited for a calendar, diagonal, or collar.