With the markets at all-time highs and continuing to climb daily, if you are sitting on the sidelines in cash you may feel that you are missing out on a

tremendous opportunity to profit from higher equity prices. Many individual investors who survived the 2008/2009 “Great Recession” still have an

internalized fear about investing in equity markets as they experienced what felt like a tsunami in their investment accounts due to lack of knowledge of

the tools/trades they could utilize to profit from that unparalleled bearish event. The scars from that time period still remain and leave many feeling

paralyzed in this environment. Is there a way to tread into the markets while maintaining a conservative approach to risk? There is – spread trading.

Utilizing options in spread trades provide many distinct advantages over the traditional “buy low, sell high” mentality most investors adopt. With options,

we can trade any market scenario to profitability – bullish markets, stagnant markets and bearish markets alike. Options provide leverage as we control 100

shares of the underlying equity for a fraction of the investment that those same 100 shares would require. We are also able to define our absolute risk in

each and every trade we place. Through study and practice, we gain the skills necessary to place appropriate trade structures at appropriate moments in the

market. We can also learn ways to make changes to active trades to profit from what the market provides rather than what we expect it to provide. This is

the “art of adjusting” that gives us a distinct advantage in the market.

One spread trade that I favor on equities I wish to own in my portfolio is the bull put. I see it as a way to get paid to own equities at discounted values

from current levels. This spread trade involves both the selling and buying of put options within the same expiration series. I sell a put at a higher

strike price than the put I am buying. The short put gives me a potential obligation to buy shares at that strike while the long put gives me the right to

sell shares at its strike. The risk in this vertical spread is that I may be required to buy shares at a higher price than I have the right to sell them

for. Let’s walk through an example to illustrate profit/loss potential in this trade.

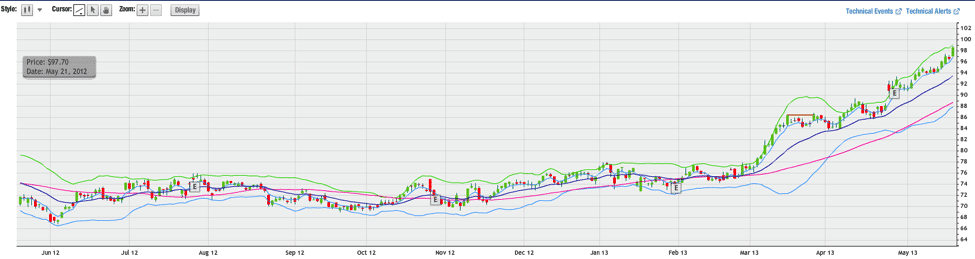

Let’s begin with the trading thesis that XYZ has bullish fundamentals and technical analysis confirms a bullish trend as it continues to breakout to new

highs daily (see the chart below):

I wish to establish a position with XYZ but feel that in the very short term the chart may be overextended. I would like to purchase shares on a pullback

opportunity. I see an initial level of support around a price point of $65/share and I would be comfortable taking shares at that level. Using June 2013

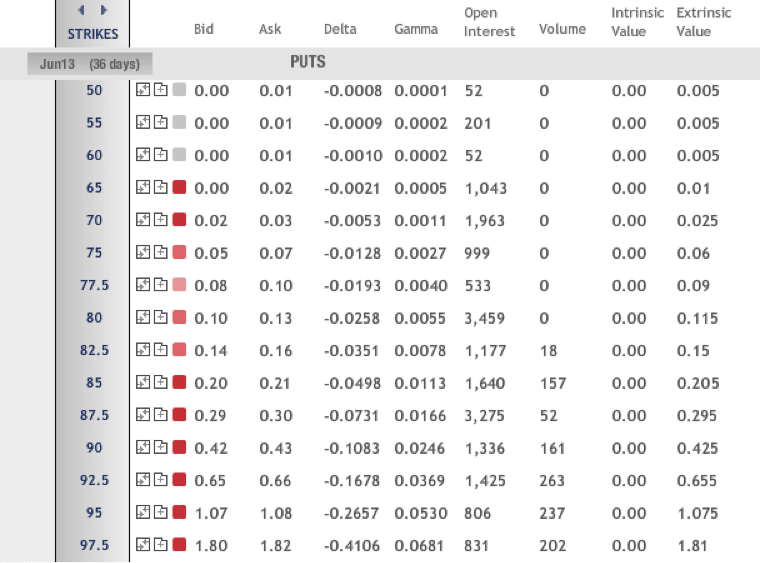

options, I can create a bull put vertical spread that makes me money even if I never buy a single share! Here’s the breakdown of the trade:

Sell to open June 2013 95 short put – bid price 1.07

Buy to open June 2013 90 long put – ask price .43

Net credit = 1.07 – .43 = .64

Risk in the trade = 5.00 spread – .64 credit = 4.36

Return on risk = .64/4.36 = 14.6% in 36 days or 148% annualized

The beauty of this trade is that as long as XYZ remains above my short put obligation at $95/share, I keep this entire credit. That means that XYZ can be

bullish, stagnant or even slightly bearish and I will still be profitable – without ever owning a single share! If XYZ goes below $95, I will be assigned

those shares at $95/share but I will keep my credit of .64 which brings my cost basis on share ownership to $94.36/share. I can then spread trade these

shares accordingly going forward. This really is “the best of both worlds” and a way to begin share ownership at a value I deem appropriate. The risk in

this trade is that XYZ begins a truly bearish trend during the next 36 days. If that should occur, there are ways to make adjustments to this trade to

minimize loss or even make the trade profitable on bearish momentum. This removes that fear of entering into a position at the wrong point in time as

equities continue their ascent.

Karen Smith

OptionsANIMAL Instructor

Options Trading Resources

options trading resources online * trading for beginners * options trading example * learn trading strategies * beginner stock market investing * option trading education