In the trading world, when you buy a put, it is called a long put. When you buy a put you are paying for the right to sell 100 shares of the equity per contract anytime you would like before it expires. The price you sell your shares for is the strike of the put you purchased and is also called the exercise price. The contract is a fiscal agreement between the buyer and the seller of the put for as long as you have the contract open. You do not have to own shares to buy a put. You do not have to have enough money to buy shares to buy a put. The total risk in buying a put is the price that you pay for it so that is all the money you need to buy a put.

People buy puts for many reasons. A put can be purchased to protect a stock position. Puts on an index can be purchased to protect a portfolio from a drop in the broad market. They can be purchased as a standalone trade or as part of a spread. The phrase “Sell in May and go away” turns in to “buy puts in May and make some hay” as long as the equity drops fast enough.

To profit from a long put you do not have to exercise it. If you expect an equity’s price to drop, you can buy a put and sell it for more than you paid for it once the equity drops. Your total investment is the original cost of the put.

Long puts have time value that decays as time passes. The longer the time period purchased the higher the initial cost. The longer a put is held, the more time value is lost. To make money with a put, the equity’s price must drop faster than the put’s time value decays. If you exercise a put you forfeit any time value that is left so it is often more profitable to sell the put and sell the stock rather than exercise a put to sell a stock position. It is a little more complicated than that. Factors like how far in-the-money the put is, changes in implied volatility, the bid/ask spread and how long until expiration also impact a put’s value.

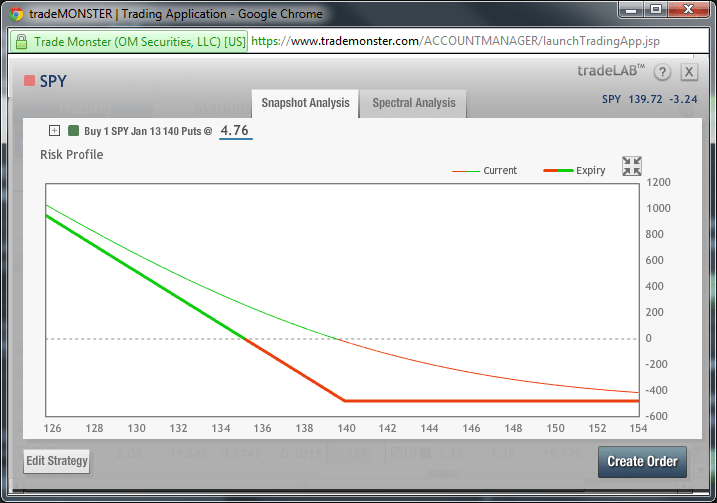

On the profit/loss chart above, the thin line is the profit/loss for a given price of the SPY today for a long put at strike 140. The thicker line is the profit/loss for a given price at that options expiration. The difference between the two lines is the time decay.

The long put can be a very profitable part of a good trading plan. Most people know how to make money in a bullish market but few know how to make money in a bearish market. The long put is one way to do it.

Ken Bailey

OptionsANIMAL Instructor

Options Trading Resources

trading classes * basic options trading * trading options course * learn to trade options * learn about options trading * stock market beginner * online options trading