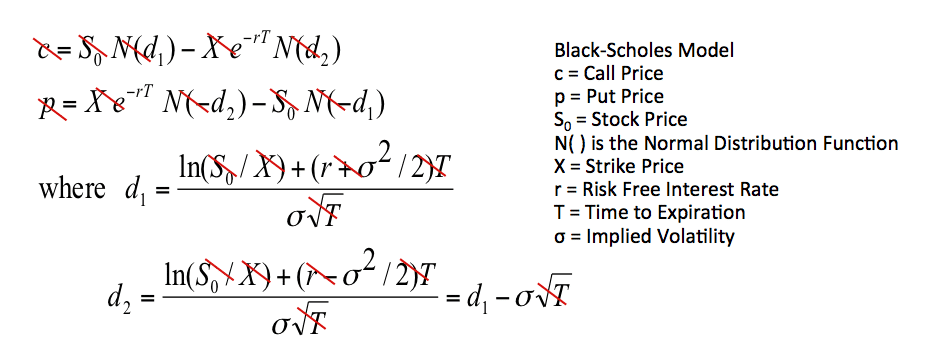

Have you heard the rumors that in October 2008 some purchasers of calls (a very bullish strategy) on the SPX actually broke even on that trade despite the enormous pullback in the market? Ever wondered how that can happen? For those who are relatively new to the world of equity options, it might seem that the premiums associated with these contracts are created “out of thin air”. In actuality, there are rather complicated-looking formulas that explain how these premiums are derived. The most widely recognized such formula is the Black-Scholes Model of options pricing. Upon first glance, you might think you need an advanced math degree to understand this mathematical equation, but once broken down, it is actually rather simple. We know much of the information needed to complete the formula:

- The put/call price is taken from the options chain

- The stock price is taken from the broker’s quote screen

- Normal distribution is a mathematical function

- The strike of the option is known

- Rho – the risk free interest rate – is known

- Time until expiration of the option is from a calendar

- Therefore, the only unknown – and what the equation solves for – is implied volatility

Since the Black-Scholes model solves for implied volatility (IV), it stands to reason that it is critical to understand how this factor impacts option value if you wish to delve into options buying and selling. Implied volatility is the market’s measure – or anticipation – of how volatile the movement of the underlying equity will be during the lifetime of the option contract being bought or sold. Remember that, at the end of an option’s life, there are only two possible outcomes for its value on the day of options’ expiration. It will be completely worthless if it expires out-of-the-money (OTM) or it will be 100% in-the-money (ITM) and derive all its value from its material advantage in the marketplace. All of the risk capital – extrinsic value- that was part of the premium initially will “bleed off” prior to expiration day. What is that risk capital to begin with? It is the market-assigned monetary value of risk that the option will finish in the at-the-money (ATM) position at the end of its life. When you look across an options chain, you can see that the risk capital portion – the extrinsic value- in overall premiums gets smaller and smaller as you go further away from the ATM position on the chain. This means that the market is giving less risk premium to options that would require significant movement of the underlying equity in order for them to change their position on the chain (think ITM options becoming OTM or OTM options going ITM). If the market anticipates a great deal of movement in the equity, it accounts for this with a higher level of IV than if it expects the equity to change value to a lesser degree during the lifetime of the options in question.

Think of IV as a balloon representing risk of movement in the equity. If IV starts to increase, the balloon inflates causing the extrinsic value in options premiums to increase. If IV starts to decrease, then the balloon deflates, causing a contraction in options premiums due to less risk capital being associated with the option. When you study the options chain, you will notice that each individual options contract has its own level of IV.

How can you use this information in your trading? At OptionsANIMAL, we teach you strategies to take advantage of changes with implied volatility on the equities you wish to trade. Some strategies work well when IV is lower and likely to go higher. Others are more appropriate when IV is elevated and likely to go lower. One thing is for certain – if you don’t understand the impact of implied volatility on your trade, you would be wise not to place that trade until you do!

Karen Smith

OptionsANIMAL Instructor

Options Trading Resources

options trading 101 * beginner stock market investing * options trading example * option trading education * education option trading * options trading community * upcoming trader workshops