On October 4th of last year, the C2 Options Exchange (C2) began trading pm-settled electronically-traded S&P 500® Index options under the ticker SPXpm. C2 is an all-electronic exchange and a wholly-owned subsidiary of CBOE Holdings, Inc.

On October 4th of last year, the C2 Options Exchange (C2) began trading pm-settled electronically-traded S&P 500® Index options under the ticker SPXpm. C2 is an all-electronic exchange and a wholly-owned subsidiary of CBOE Holdings, Inc.

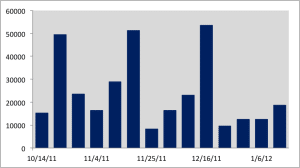

This means SPXpm options are 100% electronically traded in a very transparent market. Although only around for a few months, SPXpm volume continues to pick up as can be seen in the chart below showing weekly volume in SPXpm options.

The table below covers some of the contract specifications for SPXpm options –

| Trading Symbol | SPXPM |

| Notional Size | $100 times the S&P 500 Index |

| Exercise Style | European – Expiration Only |

| Settlement Type | Cash Settled |

| Settlement Time | PM – Market Closing |

| Market Model | All Electronic |

In the past, most individuals that wanted to initiate an option trade based on an outlook for the S&P 500 chose options on the SPDR® S&P 500 Exchange Traded Fund or SPY. But now traders are looking at SPXpm options because they have some distinct advantages over trading SPY options. SPXpm options have a larger notional value than SPY options, SPXpm options are European-style cash settled options, and SPXpm options qualify under section 1256 of the Tax Code for potentially favorable tax treatment relative to SPY option contracts.

To keep the math simple, consider the S&P 500 trading at 1300 and the SPY being quoted at 130.00. Typically the SPY is trading very close to 1/10th the size of the S&P 500. This 1 to 10 ratio translates to the dollar amount of S&P 500 exposure that positions in the respective options will give a trader. Both SPXpm and SPY options are quoted with a multiplier of $100. Since the level of the S&P 500 is ten times that of the SPY it takes 10 SPY options to represent the same dollar amount of S&P 500 exposure as a single SPXpm option.

For example, again with the S&P 500 at 1300, if an investor wanted to protect a $260,000 portfolio that tracks the S&P 500 through March expiration he may consider the following two put options –

- SPY Mar 130.00 Put @ 5.00

- SPXpm Mar 1300 Put @ 50.00

By using the SPY options, the investor would need to purchase 20 SPY Mar 130.00 Puts @ 5.00 for a total cost of $10,000. The same protection may be acquired using SPXpm options by purchasing just 2 SPXpm Mar 1300 Puts @ 50.00 each, again for a total cost of $10,000. Note neither of these examples includes commissions. On a per contract commission basis, the cost is going to be higher for the 20 SPY put contracts as opposed to the 2 SPXpm put contracts.

SPXpm options are European-style and may only be exercised at expiration. This may be an advantage relative to SPY options which are American-style options. American-style options may be exercised early which may be a concern when implementing short option positions. Sellers of American-style options may experience early assignment on those options. This is not a risk that a trader incurs when trading European style-contracts such as SPXpm contracts.

Also, SPXpm options are cash settled. The result of an in-the-money long position in SPXpm options would be to receive a cash payment upon expiration. In reverse, at expiration, an in-the-money short position in SPXpm options would result in a cash payment to the holder of a long position in SPXpm options. In neither case is there a transaction in an underlying security. With SPY options, if a contract is held to expiration the result would be delivering or receiving 100 shares of the underlying SPY ETF for each contract. If the goal behind a trade in SPY options is capital appreciation and does not involve buying or selling shares of the underlying SPY ETF, then the option position may need to be closed out before expiration. In the same situation a closing transaction would not need to be executed in SPXpm options.

Finally, under section 1256 of the Tax Code, profits and losses on transactions in certain exchange-traded options (SPXpm included) are entitled to be taxed at a rate equal to 60% long term and 40% short term capital gain or loss, provided that the investor involved and the strategy employed satisfy the criteria of the Tax Code*.

So, if you are considering an option position based on an outlook for the S&P 500 index, take a look at the new SPXpm options. They are fully electronic so the market you see is what you get. Also, you can get a lot more bang for your buck relative to SPY options.Click here to learn more about SPXpm options.

CFA – Instructor – The Options Institute

Options involve risk and are not suitable for all investors; in fact there may be no 100% safe option strategies. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, by calling 1-888-OPTIONS, or from The Options Clearing Corporation at www.theocc.com. * Investors should consult with their tax advisors to determine how the profit and loss on any particular option strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations. C2, C2 Options Exchange and SPXpm are service marks of C2 Options Exchange, Incorporated (C2). S&P®, S&P 500® and SPDR® are registered trademarks of Standard & Poor’s Financial Services, LLC and are licensed for use by C2. Copyright © 2012 C2. All rights reserved.

Options Trading Resources

options trading system * beginner investor * education option trading * options trading seminars * learn trade adjustment online * options trading example