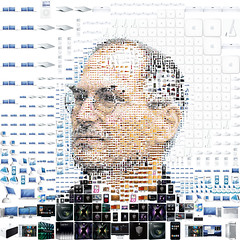

Image by tsevis via Flickr

Steve we will miss you!

The announcement that Steve Jobs is stepping down from the role of CEO at Apple Inc. (AAPL) should come as a surprise to no one. The man has been very sick for some time and it has been a testament of his strength as a person and his passion for Apple that he has stayed as long as he has. This man should go down in the same realm as Thomas Edison and Benjamin Franklin for the changes that he has brought to business, technology, and life in general. As a person who has followed (from a distance) the mogul of Steve Jobs and how he has affected the investing community, I have to say that I feel like I am losing an icon that will be hard to replace. I will miss you Steve.

The company will get hit tomorrow. Not just in their stock price, but the company itself. The brilliantly talented team of people in Cupertino, and the rest of the team spread across the world will all be in a place tomorrow that they haven’t been in for some time: without Steve. As always with change, there will be some commotion, but I really don’t think that this is going to be as challenging for Apple as the market will react initially. Like I said, this is a surprise to no one, especially those at Apple. In time, he will be looked back at as the visionary who started one of the best companies known to man.

As for the market… who cares in the long run. Apple will come back. For those of you who use fundamental analysis to make your investment decisions, Apple will continue to innovate without Steve. Their brand loyalty will not leave. I am not going to sell my iMac and go buy a Dell because Steve is leaving. In the short-term however, the bearish move that AAPL has, may create a great opportunity for those of you who missed getting in. As I am writing this, AAPL is now down about $20 in the after hours trading. ($356). It may go lower. The stock could go as low as $343 (200 MA) in this frenzy. I will not make a major bearish adjustment unless it breaks below that level.

That is the beauty of the collar trade. Collar trades allow for the adjustment of a position if expectation changes. In the short term for me, I will adjust to a collar by adding puts to my trades. In my opinion, the long run will still bode well for Apple as Apple’s succession plan will turn out just fine. In the short term, let the market move, and I will move with it.

Thank you Steve for your contribution to society . You will be missed (from a distance) here at OptionsANIMAL.

Greg Jensen

CEO & Founder of OptionsANIMAL

Options Trading Resources

option course * options trading course * trading examples * learn to trade options * learn about options trading * online options trading * options trading 101