Recently I received an email form one of our students. He had been reading James Bittman’s book “Trading Options As A Professional” (available through the OptionsAnimal bookstore:http://astore.amazon.com/option0e-20 ).

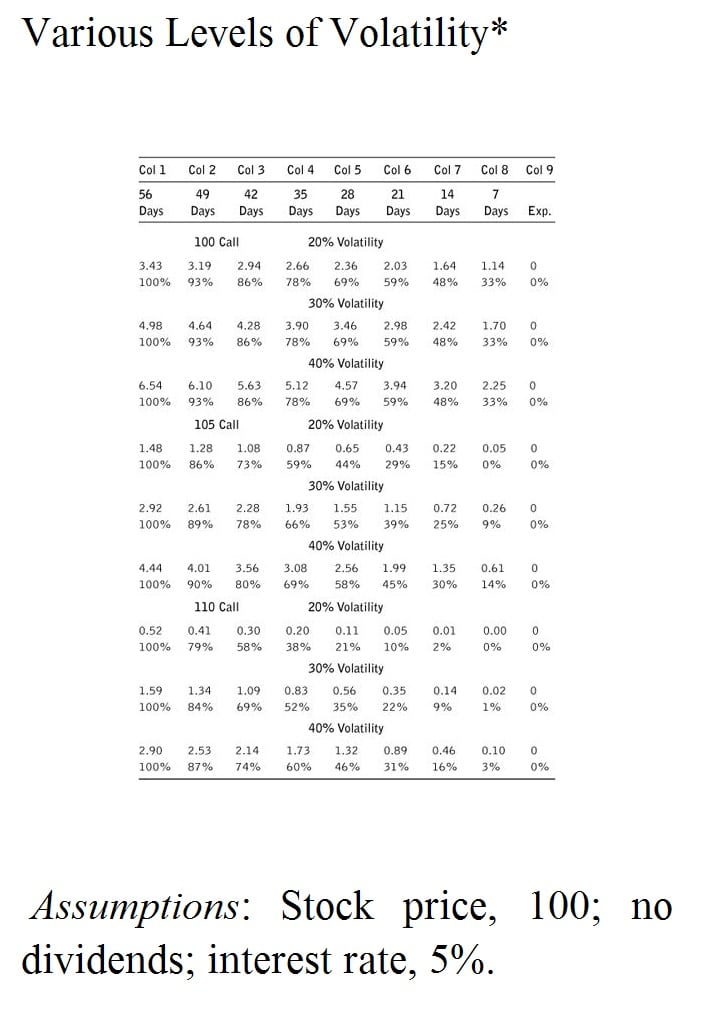

The table in question is posted below for your review:

The point that Mr. Bittman makes is that OTM options with two months of time value will decay more in the first half of their life than the second. Therefore these are the options that should be sold, then covered when they reach one month of time value remaining. This simply reflects the same principles that we teach here at OptionsAnimal. Specifically, that is, that an options value is the market’s expectation of whether or not the option will expire in the money. With two months to go, there is a statistically higher probability of an OTM option becoming an ITM option than there is for a one month option at the same strike price.

With no movement by the underlying equity, (as was a “given” for his table and calculations),and with 1 month of the original two remaining, the probability has decreased by MORE than half. Think of it this way, if you hold a stock that you bought for $100, and it drops to $50, that’s a 50% loss. Now, to get back up to $100 it must make a 100% increase in value (from 50 to 100). Now, the constraint is a bit different here (dollars instead of days), but from a statistical perspective, it is nearly the same. Half the time is not exactly half the probability (i.e. 50%), it’s something on the order of 33% probability and THAT will change based on how far OTM the option in question is AND the implied volatility…. It would still have to move from 100 to 105, for example, but now instead of having two months to do it, it only has one…

Also note that the ATM option DOES follow the path that we talk about. The rate of decay is the greatest for the ATM option in the final 30 days. As you go OTM AND ITM, that relationship changes. This is as it should be. As time passes by, the expected absolute movement of the underlying becomes less and less, therefore options that are already ITM are expected to stay that way (no real risk – no extrinsic value), and options that are OTM are expected to remain OTM to options expiration. For them to do otherwise would require a significant departure from their past price behavior.

All of this discussion is theoretical of course. In the real world, all the variables that create an options price are constantly changing. To assume that IV will remain the same for a two month period is absurd. To assume the price will remain static – likewise – equally absurd. Understanding that an ITM or OTM option will lose more of its value in its first month instead of its last, should make sense when thought of through the eyes of probability which is exactly what options are – a measure of risk at this moment.This all makes perfect sense and is just a much more detailed look at time decay.

Keep in mind, this entire discussion is to contrast OTM options with ATM options at varying levels of IV. When IV increases, it has the same effect on an options price and it’s Greeks as adding additional time value to the option!.

There is nothing wrong with this approach to selling options. However, please note the differences in the amount of premium that is collected at the varying strikes… So while he says that he is keeping a greater percentage of the premium by going ITM, he is getting a bigger portion of a much smaller number!

Learn, master, trade…

Jeff McAllister

OptionsANIMAL Instructor

Options Trading Resources

options trading education * online trading classes * beginner investor * options trading classes * options trading system * learn trading strategies * options trading example * online options trading information