Apple (AAPL) earnings are scheduled for July 22, 2014 after the market close. Every quarter, this is one of the most anticipated earning events. Why?

Because when the crew from Cupertino get on the phone to discuss the performance of over the past three month, everyone listens. Apple is America’s largest

company, by market capitalization – which was $440 billion as of July 13. It is also one of the most held stocks in the US – with several institutions

holding tens of billions of dollars in Apple stock. Because of those factors, when Apple moves, markets can move.

What do we know about Apple going into earnings? Now, I am not talking about the iPhone 6, wearable health monitors, home automation, new televisions, or

the mind-reading feature being enabled on Siri. I am talking about the stock and options action.

What do we know?

Because the market knows that Apple typically makes a big move around earnings, traders tend not to make big buying or selling decisions. This causes the

historic volatility of the stock to drop. What traders tend to do before earnings is either:

- Hold off on any decisions until after earnings;

- Buy calls, puts, or both to speculate on very bullish, very bearish, or moving in either direction

- Buy protection in the form of a protective put or a collar trade;

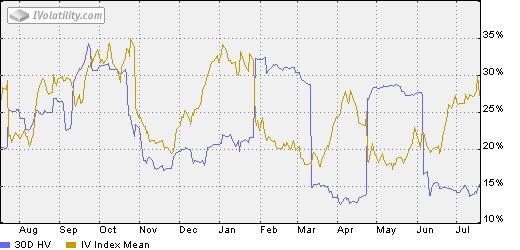

These actions can be seen in the following graph from iVolatility.com.

The bluish line is the 30-day historic volatility. We see that the historic volatility tends to be low before earnings events. Then is spikes up because of

those big one-day moves. We see the historic volatility fall off a cliff 30-days later. That is because that big one-day move is no long included in the

30-day calculation.

The other line on this chart is the implied volatility index. It is essentially a way to look at the relative price of options. What we see with Apple is

that it rises before events and then falls after the event. The demand for options causes the rise – consider the second and third things that traders do

before Apple earnings.

1) Long Calls, Puts, Straddles, or Strangles

Knowing that Apple is going to a big move, some traders will gamble on the direction by purchasing calls, puts, or both. By purchasing both – also known as

a straddle or strangle – traders, could stand to profit for a big move in either direction.

On the surface that seems like a good idea. However, experienced traders know that this is a hard trade to make work. The reason is the high implied

volatility. Consider two equities that trading at about the same price right now: QQQ $95.27 and AAPL $95.22. The QQQ August 95 straddle is trading for

$3.60 per share (one contract would cost a trader $360.) The AAPL August 95 straddle is trading for $6.38 (one contract would cost a trader $638.)

Why would the AAPL straddle cost nearly twice the QQQ straddle? It is because there is a bigger risk of movement in AAPL than in QQQ. That is why the

implied volatility is high. AAPL will need to make a huge move in order for a straddle to be profitable.

Also, remember that yellow line that drops after the earnings event. That is known as Implied Volatility Crush. After the event, the implied volatility

will fall causing the value of the puts and calls to fall as well. Occasionally, a trader can outsmart the market and get a straddle or strangle to work.

This happens when the news is significantly better or worse than the market anticipated.

2) Naked Straddles or Strangles

Some traders who recognize that buyers of straddles and strangles tend to lose money, prefer to sell straddles and strangles. That trade is known as a

naked straddle. This trade will make money from a move that is not to drastic. It also makes money from the IV Crush that hurts the straddle/strangle

buyers. The problem is while naked straddles and strangles frequently make a small profit, when they lose, they lose BIG.

You can lose more than your dignity going naked.

3) Collar

For traders who have shares of Apple and want to lock in their profits or protect themselves from a bearish move, a collar trade can be ideal. In this, you

would sell a call against your stock and use those proceeds to buy a long put. The call obligates you to sell the stock if your short call expires in the

money. The long put gives you the right to sell your stock at the strike price. If you purchased AAPL just about any time the past year, you can structure

a collar so that your outcome is either: a) make money or b) make more money. The downside of the collar is that if the stock makes a big move up, your

upside is capped.

You cannot go broke making a profit.

4) Credit spreads: Bull Put, Bear Call

It is difficult to structure a trade that will make money with an explosive move – either bullish or bearish. Those trades all involve long options that

are subject to IV Crush. However, if a trader is willing to pick a direction, they can make money from a vertical credit spread. Bull Put for bulls and

Bear Call for bears. These trade make money with the passing of time, directional movement of the equity, and a drop in implied volatility. They are higher

probability trades that typically work more than 50% of the time. Take the Bull Put for example. A trader sells an out-of-the-money put and buys a put at a

lower strike. That extra long put means they are not “naked.” It offers protection to the downside by limiting their risk. The key to being successful with

these trades is to have a plan in place when the trade goes against you.

5) Make money before earnings

Knowing that AAPL’s historic volatility tends to fall before earnings and the implied volatility tends to rise, a trader who structures a trade that is delta neutral, theta positive, and vega positive could benefit from this behavior. A double diagonal is a just such a trade. I make money in a stagnant trend with rising implied volatility.

Unfortunately, it is too late to place that trade. The ideal time was several weeks ago. Fortunately, AAPL will have earnings again in the future. (I am guessing in about 3 months.)

The double diagonal is a simple trade to understand. However, it can be complex to manage, especially if the stock trades outside of the short options. Traders must have a well-designed trading plan. They need to know when to take profits and what to do when the trade goes against you.

Traders would be wise to paper trade this before using real money.

What am I I doing before earnings? I am a shareholder. I plan to collar my stock so that I will either make money or make more money. I may also take a small speculative position. However, my risk will be limited, and my trading plan will be well defined.

Eric Hale

OptionsANIMAL Instructor