Do you want to know where the stock market is going between now and November 6th?

Leave your political opinions at the door. This will need an open and unbiased mind.

In the midst of the stock market crash of 2008 there was another very important historical event going on; it was the US Presidential Election.

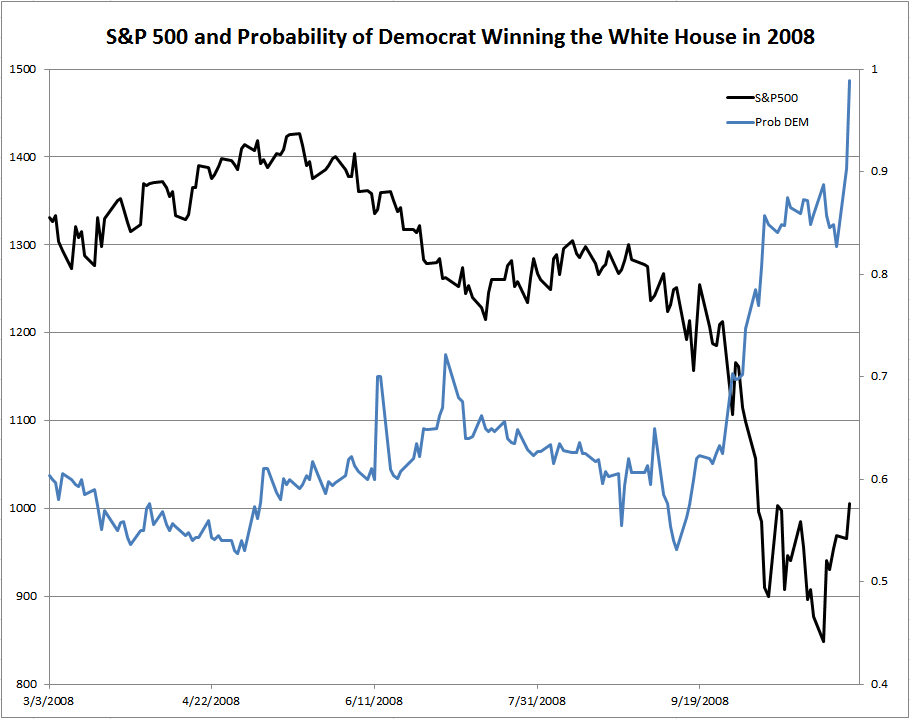

During this period, it seemed to me that the rising popularity of the Democratic candidate moved in the opposite direction of the stock market. Curiosity led me to explore this further.

It is difficult to get unbiased probabilities from traditional news and polling sources. As impartial as they may claim to be, they still have biases. But, there is a reliable way to find these sorts of probabilities. Economic researchers have found that outcomes are best predicted when there is a real cash market behind them. The University of Iowa’s Henry B. Tippie College of Business has created the Iowa Electronic Markets (IEM http://tippie.uiowa.edu/iem/), where futures contracts can be purchased based on real world outcomes.

The IEM now offers futures for congressional, presidential, and Federal Open Markets Committee monetary policy events. For example, the Democrats losing the Senate Future in the next election (trades under the symbol DS.lose12) is currently selling for $0.354. That means you are betting $35.40 to win $100.00. The price of the future is essentially the probability of that outcome. As of this writing, that means that there is a 35.4% chance that the Democrats lose the Senate.

It’s a very interesting economic theory. It’s similar to the concept of sports handicapping. Bookmakers do not set the odds or the point spread. It is the betting volume that sets the odds. The bookmakers change the odds to balance their risk.

I was watching the IEM during the 2008 election and I noticed a disturbing trend in the market. While the market was falling, the probability of the Democratic candidate being elected was increasing. They seemed to move in opposite directions.

Regardless of your political opinion, you cannot deny that there appears to be an inverse trend between these two sets of data.

Please, hold on to your emotions. Bear with me and let’s look at the math. A correlation analysis using Microsoft Excel indicates a -89.3% correlation between the two sets of data. That is a very high and undeniable degree of negative correlation.

But, causation and correlation are not the same.

Would the market be going down because a Democrat’s probability increases? Or would the probability of a Democrat winning the White House be increasing because the market is going down? I have heard arguments for both.

Break out your pocket protectors, because I am about to get my geek on. A way to evaluate which is causing the other is to perform a Bivariate Granger Causality analysis. This essentially considers the “lag” between two correlated sets of data to determine which could be causing which. (I performed the analysis using Wessa, P. 2012, Free Statistics Software, Office for Research Development and Education, version 1.1.23-r7, URL http://www.wessa.net/.) Without going into the gory details, the analysis concludes that the stock market is not causing the Democrat’s probability to change.

Using Granger Causality method, it is easier to reject a cause than it is to determine a cause. The best that can be determined is that it is possible that the probability of a Democrat winning the White House is causing an inverse response on the stock market.

In English, it’s possible that the probability of Barack Obama winning the presidency in 2008 was driving the market lower.

To evaluate that hypothesis, it requires some different thinking.

It is reasonable to assume that the market does not want to see the White House change from Republican to Democrat? Yes, that is reasonable. In fact, I believe that it is arrogant to suppose that the outcome of elections do not have an impact on the economy and the market.

With the change of an administration, there are bound to be winners and losers. Some businesses will thrive and others will have challenges.

One might be tempted to conclude that it is Republicans who are “business friendly” and better for the economy and stock market. That may be true and the data from 2008 might support that. But, hold off on that conclusion for now.

Let’s consider the current 2012 presidential race.

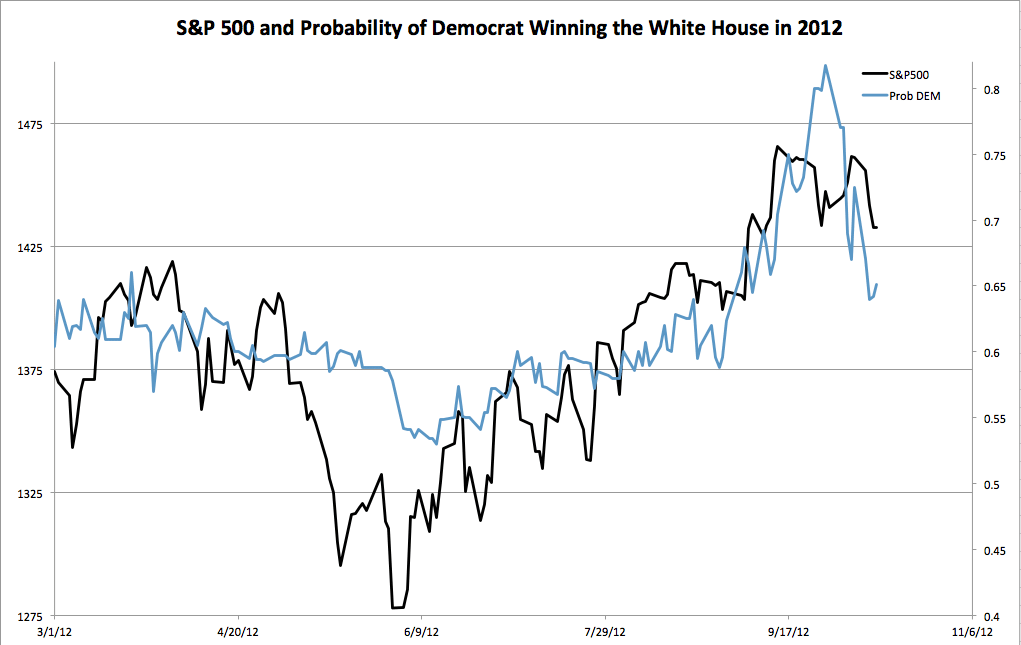

Looking at this chart, you would conclude the opposite of 2008. The probability of a Democrat winning the election is positively correlated to the stock market. And the analysis supports that conclusion with a +74.5% correlation. The correlation is not as high as we saw in 2008, but the “tightness” of the correlation was not realized until the last few weeks of the election. (And, just two weeks ago the correlation was only +69.3%.)

How does the Bivariate Granger Causality analysis play out? The same conclusion as 2008, the movement of the stock market is not being caused by the probability of the Democrat being reelected. It is likely the other way around: the stock market movement is because of the probability of Barack Obama being re-elected is increasing.

So, now I have succeeded at alienating the other half of the readers.

What is the theory that supports this? I believe that some companies will do well with a change of administration, but it is difficult to pick the winners. What is more clear is that some companies will do poorly when the White House changes between political parties. Therefore, when the likelihood of the incumbent party staying in power rises, the shares of those companies (who would otherwise do poorly under a new administration) will tend to rise along with the incumbents probability of winning the election. That rise is enough to move the market with it.

I think it is more succinctly stated as: the market hates uncertainty.

I am not going to pick which companies or sectors will do poorly or well during the rest of this election season. I will leave that up to the reader. I do believe we will continue to see the S&P 500 run up if the probability of Obama being reelected rises. I also think a surge of the Romney ticket will likely drive the market lower.

Personally, I have been trading this using the SPY (the S&P500 ETF) which is an excellent proxy for the overall market. Since the probability of Barack Obama’s reelection tends to move before the market, I have watched the probability data and entering or exiting my trades accordingly. Sometimes it takes a few days for the trend to follow through. But, it has worked pretty reliably for the past few weeks.

With the election rapidly approaching, this strategy only a has few more weeks. I urge all traders to do their own due diligence and take responsibility for their own trades. After the election, the market will go back to moving because of QE4, European Debt Crisis, Fiscal Cliff, or the phase of the moon. Until then, I know how I am trading.

I know that I violated an age-old adage: that you should never talk about religion, politics, or money. I have broken two of those taboos by discussing both politics and money. However, one of the most important attributes of a successful trader is the ability to control emotions. Do not let your personal biases affect your perception of what you are seeing. Take the data that you are given, analyze it, make a hypothesis, test it, and then act. And, to quote John Maynard Keynes, “When my information changes, I alter my conclusions. What do you do, sir?”

Eric Hale

OptionsANIMAL Instructor

Options Trading Resources

beginner investor * trading classes * options trading classes * options trading courses * trading system * online options trading information