Stop using “Stop Loss Order”

by Eric Hale

Among stock traders, a common approach to limit risk is to implement a stop loss order. This is an order placed with your broker to sell a stock if it falls below a certain price. It can be an effective way to limit your losses. However, it is not the only way to protect your investment. As a OptionsAnimal student, I have learned to stop using stop loss orders and use option strategies to not only protect my investments, but to turn losing trades into winners.

Options are often used by investors to protect their investments. Using a relatively small amount of capital, an investor can buy insurance against a move in either the bullish or bearish direction. A long put option will increase in value in the event of a move down – bearish. Contrarily, a long call option will take advantage of a move upward – bullish.

Since a long put will increase in value as the stock declines, a trader could use a long put to offset a loss in the stock. This approach is known as a “protective put” or “married put.” The long put is a contract that gives the option holder the right to sell their stock at the agreed strike price by a specific date.

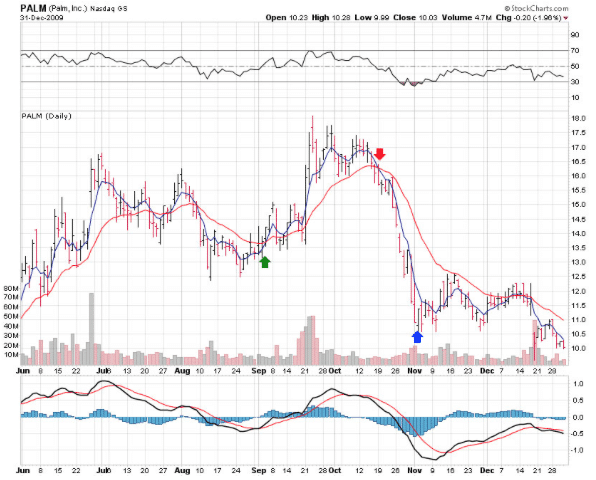

Stop Using Stop Loss order example Ticker PALM

Consider the following example on PALM: a trader purchased 1,000 shares of PALM stock at $14.21 on September 2, 2009 because it gave strong technical buy signals. The initial investment is $14,210 (1000 x 14.21 = $14,210). By October 19, 2009, the stock was at $15.69 (+1.48) but also gave strong technical sell signals. Because the trader maintains a bullish outlook, but believes that there may be a slight pullback due to the technical indicators, the trader decided to buy 10 long puts at the $16 strike 10 x 16 = 160. Those $16 strike puts give the options holder the right to sell 1,000 shares of PALM stock for $16 (1000 x 16=$16,000) , regardless of where the stock is actually trading. If the stock drops to $10 dollars, the options holder still has the right to sell their stock at $16.

When considering the protective put, the trader is given many “options” to choose from. Which is the right option? There are two components to that question: strike price and which expiration month.

With regards to strike price, higher strike puts cost more than lower strike puts. A good analogy to the protective put is to consider buying home owner insurance. An insurance policy with a lower deductible will give you more protection and thus, will command in a higher premium. A higher strike put option will give more protection and costs more to buy than lower strike puts.

Picking the right strike comes down to a matter of determining what you are trying to protect: your cost basis or your profit. For example, with our example above, the trader purchased PALM at $14.21. By October 19, the stock was at 15.69 (+1.48) but also provided sell signals. The prudent decision is to add a protective put to the stock. The closest option strike is at $16. A protective put at $14 would cost less than a higher strike and cover less of the cost basis. Because the trader was looking to protect more of the profit, he selected the $16 strike. The price that is closest to where the stock is trading is called the “at the money” strike.

The other part to consider when buying a protective put is the expiration month of the option. The analogy of insurance applies again when considering which expiration month to consider. If you are purchasing insurance for one month, it is going to cost less than if you purchased insurance for a full year. Current month options cost less than options further out in time.

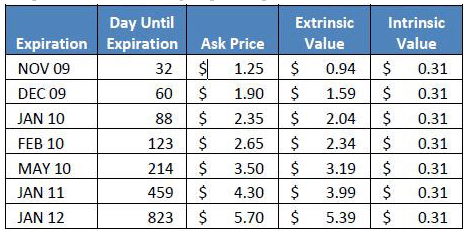

On the surface, it might seem that the shorter term month options are a better value because the price is lower. However, it is important to consider the factors that affect options pricing. Options pricing can be divided into two components: intrinsic value and extrinsic value. The intrinsic value is the amount by which an option is “in the money.” For a put, the intrinsic value is how much higher the strike price is than the stock price. If our PALM stock is trading at $15.69 and we have a $16 put, it is considered an “in the money” put. Why? because it is higher than the trading price of the stock. The intrinsic value of the $16 put is found by subtracting the stock price from the put strike: $0.31 (15.69 – 16.00 = .31). Put options that are below the stock price are considered “out of the money” options and have no intrinsic value. The other part of the option pricing is the extrinsic value and it is found by subtracting the intrinsic value from the actual price of the option being considered. Since the trader already decided to purchase the 16 strike, he had several months to choose from.

Sometimes extrinsic value is referred to as the “time value.” As that term implies, more time in the option will result in a higher priced option. This can be seen in the table below.

The factors that impact extrinsic value include the stock price, time to expiration, dividends, the risk free interest rate, and something called “implied volatility.” Simply stated, implied volatility is the anticipated variability in the stock over the life of the option being considered. Implied volatility has a significant impact on options pricing. Understanding implied volatility is essential to successfully trading options.

To understand extrinsic value we could use the analogy of insurance again. Suppose that you were able to purchase home owners insurance on a month to month basis. If you happened to live an area that was prone to seasonal hazards, like hurricanes, you would expect that the premium would be higher during hurricane season. And if you decided to buy the insurance a few days before landfall, and your house was on the trajectory for a hurricane, you would expect that the insurance company would want to charge you an even higher premium.

The extrinsic value of options is similar, if the stock was on trajectory for your strike, you would expect that premium to rise. In the case of stocks the best trajectory is always the current price. Stated another way, the best estimate of a stock price at any point in the future is the current stock price. Therefore, we see the highest extrinsic value in the “at the money” strike – the strike closest to the current stock price. This is true for the current month and out months.

Implied volatility can pump-up the extrinsic value by an increase in the anticipated variability of the stock. If there is a greater chance of a stock movement we will see an increase in the extrinsic value of the options due to the increase in implied volatility.

When do we need to be concerned about hurricanes hitting out stocks? The most common event that can result in stock movement is earnings. Other events might include trade shows, press conferences, regulatory events – like FDA approval, results of a test trial, or even a peer company’s events. As options traders we need to be very aware of these events as they will have dramatic impacts on our option trades. It is entirely possible to see a doubling, tripling, or even halving of your options during these periods. This could even happen without a significant movement in the stock. When the proverbial storm is approaching, the cost of protection increases due a rise in implied volatility. Sometimes this increase makes options seem expensive and tempts people to eschew insurance at the very time that they need it the most!

After the event passes, it is not uncommon to see premiums drop dramatically with no change in the underlying equity’s trading price.

Getting back to our protective put strategy, and considering which month to consider: while the price of current month options at any strike are significantly lower than the months in the future, they are not always the best value. As mentioned above, at options expiration, an option will only have intrinsic value. The extrinsic value will decay to zero at expiration. This decay will affect shorter term options more dramatically that longer term options. The decay can be measured and is represented by the Greek letter theta. Theta tells you the amount that the option will change in one day due to time decay. Long options – both calls and puts – always have a negative theta, meaning that a portion of the extrinsic value will decay with the passage of time. Shorter term options have higher theta decay than long-term options. That rate of decay accelerates dramatically as expiration approaches. On a per-day basis, longer term options will lose less value than shorter term options – the theta is less significant. While they cost more money, they decay slower, thus representing a better value when considering time decay.

Longer term options have another benefit when it comes to the nature of implied volatility. Since most traders buy options in the month that the event will occur, you will see a dramatic change in implied volatility for the months with earnings. While out months are subject to fluctuations in implied volatility, the month with the event (e.g., earnings) tends to be impacted more greatly.

Consider the trader with PALM stock at $15.69 with a protective $16 put option with a February 2010 expiration. The initial cost of the stock was $14,210. Adding the 10 February puts at the $16 strike costs $2.65 per contract and brings our cost basis to:

$16,860 (14,210 + (2.65 x 1000) = $16,860).

We can see from the chart that the stock made a precipitous drop following the technical sell signals. It was trading as low as $10.58 (-5.11) on November 4, 2009. By that day, the value of the stock dropped by $3,630. However, the long put increased in value to $5.60. The net value of the trade, considering the stock and the put options, is $16,180. The result is a net loss of $680 (16860 – 16180 = $680). While no trader is happy with a loss, the consequences were far less severe because he owned the puts.

This is not the end of the story. The trader is left with two very tradable instruments – the stock and the long put. Shortly after the November 4 low in PALM, the technical indications were for a stagnant trend. A common strategy in a stagnant trend is a “collar,” or “collar options strategy,” which involves long stock, long put, and short call. By adding the short call to the trade, the “protective put” becomes a “collar.”

The protective put strategy described here is only one example of how a trader could have traded this situation. Depending on the trader’s goals, risk tolerance, and sentiment, there are a number of different ways the trader could have approached this trade. If the trader was very bearish on October 19, he would have purchased more puts or puts a higher strike to provide even more protection. For example, if the trader purchased twice as many puts (20 contracts), the trade would not have been at a loss – it would have been profitable by $2,270 on November 4.

There are almost an endless number of strategies and adjustment. OptionsAnimal provides a complete set of strategies that allow a trader to pick the right one for any market or trend. Options strategies are fairly well-known. What makes OptionsAnimal unique is teaching traders to adjust trades, not only when the hurricane is heading but when it changes course and heads in a different direction. By understanding strategies like the protective put and the collar trade, traders have just two versatile tools to approach the market. However, those are only two strategies. There are dozens of strategies. Successfully trading options requires developing the strategy, picking the right instruments, and then following through on a trading plan.

The result is a method has been proven to be successful and takes the elements of fear and greed out of the equation.

Eric Hale

OptionsANIMAL Instructor

Options Trading Resources

trading system * trading options course * options trading education * trading examples * beginner investor * learn about options trading