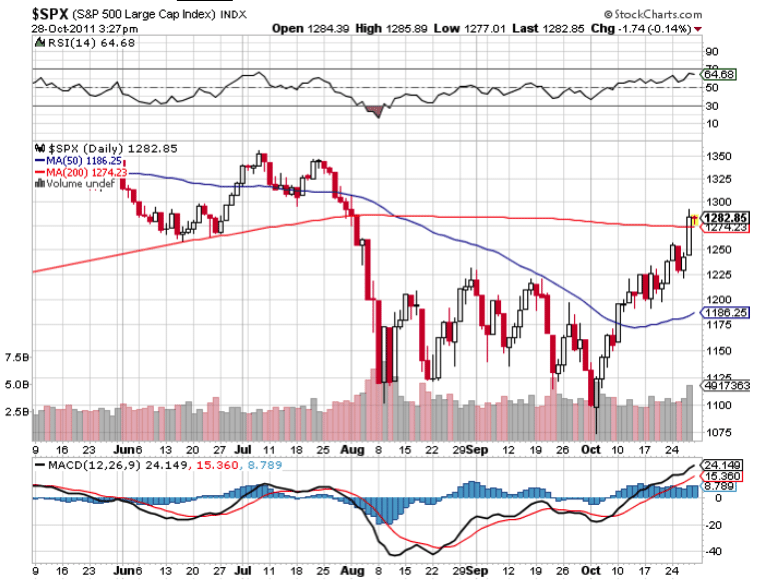

This week we saw the markets continue their rally for the 4th straight week. We are now comfortably above recent resistance levels of 1220-1225 on the SPX.

We also saw a significant breakdown in the most widely followed fear index in the markets, the CBOE VIX index. VIX broke below the 30-31 level this week, a support level it had been holding ever since the historic downgrade of the US sovereign credit rating on Aug 5th.

The question is whether this rally will have legs going into the end of the year and beginning of next year. Although it may be too early to tell, we have some good signs that the rally will continue until year end and possibly spill over into Jan/Feb 2012.

Technical analysis on the SPX shows that not much profit taking is taking place today although we had a really good week and an exceptional bullish day yesterday. Volume on the SPY, the Exchange Traded Fund (ETF) that tracks the S&P500, is 156 million shares in the last hour today compared to 389 million yesterday and an average volume of 233 million shares a day over the last 200 days. We are also holding above the 200 Simple Moving Average (SMA) at 1274 on the SPX for the 2nd day in a row. If we can hold this level all of next week then a Christmas rally become much more likely.

Technical analysis of the VIX shows a series of lower lows and lower highs since Oct 4th. VIX broke its support of 30-31 this week pretty convincingly. It continues to spike up to its 20 day Exponential Moving Average (EMA) and breaks down to make a new lower low…a classic bearish pattern indicating fear premium if coming out of the market. VIX is far from being oversold yet which means we could see a continued slide in this index next week. We need to see the VIX break below its 200 SMA at 23.59 to get more signs of an end of the year rally.

Of course, there are many reasons why this is happening this week. Money managers are trying to recover from a bad year as many of the biggest funds are down 30-50% this year. If there is a rally to be had, none of them can afford to be on the sidelines and miss the rally. Even if it is just window dressing for the end of the month (and then for end of the year) the markets could get enough momentum from the late comers in this rally to continue to move higher.

Earnings season has been very supportive as well with 60% of companies beating estimates and 70% of SPX stocks beating estimates. Market leaders like AAPL, GOOG and IBM are also holding on to their recent gains.

We saw GDP Advance numbers yesterday for the 3rd Quarter come in at 2.5% which was better than the consensus of 2.3%. Today we saw personal spending in Sep jump 0.6% meaning consumers are continuing to spend money (see my last blog post on Sept 27 2011). Who cares is consumer confidence is low as long as they make more and spend more? In other words, the fear of recession that was being priced into the markets is now moving to the sidelines and investor confidence is turning bullish again.

Finally we some a bit more clarity on the EU sovereign debt situation and that helped us out this week as well. To be sure many details are yet to be hammered out but the anchor weighing down the markets has been temporary lifted. It probably will come back to haunt us later but that doesn’t mean we can’t have a rally in the meantime, just look at what happened last summer.

Charan Singh

OptionsANIMAL Instructor

Options Trading Resources

education option trading * learning to trade options online * option trading strategies * options trading education * beginner investor * options trading professionals * market trading coaching * option trading course