If you’ve been in the Stock Market for a few years or more, you may have noticed the beast changes, and yet stays the same. Some markets seem to defy gravity and run up beyond what you, the investor/trader, believe is sustainable.

Other times the market correction will last longer than you can withstand the pain of watching your equities drop in value. These market movements can cause one’s emotions to trigger a full-tilt imbalance resulting in decisions which aren’t rational. Gaining control of emotions comes with study and practice.

Many books have been published about former market greats and their development to Market Greatness. A common characteristic among all of them is the personal discipline to learn from their experiences. Taking the time to review trades after they have been closed is the method by which we learn what we did well, or what we need to change to become more successful. We definitely want to do more of “what we did well” but the most important outcome of trade reviews is to find areas that need improvement and the development of a subsequent plan to carry out the improvements.

For example, in February 2011 SINA broke below its five and a half month-long channel line as it sliced below its 50-day moving average (a key level of support followed by many institutional fund managers). If you saw this as an opportunity to enter a bearish strategy, you were not alone. Just a few short weeks later, however, SINA climbed back above this key support level and made a stunning advance beyond the upper limits of the original channel line – a 98.2 percent increase in price in just over six weeks! Would you have been flexible enough to capture some of that bullish move? It would have required a full emotional capitulation from a Bearish Expectation to a Bullish Expectation in short order.

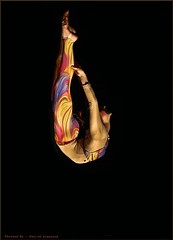

Flexibility is defined as “adaptable to change.” This is one skill the Great Market Traders of all-time polished to perfection. It can be very rewarding!

Emilu Bailes

OptionsANIMAL Instructor

Options Trading Resources

options trading example * options trading class * learn option trading * options trading classes * online trading education * beginner investor * learn trading strategies