An important part of making investment choices is to understand the context for the market and our current position in the long-term economic cycle.

This is a discussion of my view of the US stock market today and its potential short term direction. Lets look at recent market developments, including a look at the S&P500 (SPX) and its Volatility Index (VIX). My current view is that the market will remain stagnant to slightly bullish in the short-term. A pullback, if it does occur, will represent a buying opportunity.

Before I begin my commentary, I want to emphasize that my ability to make money is not entirely riding on my thesis being correct. The OptionsANIMAL method, we do not simply rely on our expectations coming true. Rather we develop an exit plan detailing how we will use options to turn our losing trades into winners by making trade adjustments.

On the S&P500 (SPX) we are within 1% of highs of 1370 set in May 2011. Many experts are warning that the market is due for a pullback. Indeed, the Dow Jones Transports have already been rolling over for the last three weeks. There are certainly enough reasons out there to justify a correction soon. But here are some things to keep your fear in check:

- Market is trading at a lower multiple than long-term averages, even after the nice rally we have had.

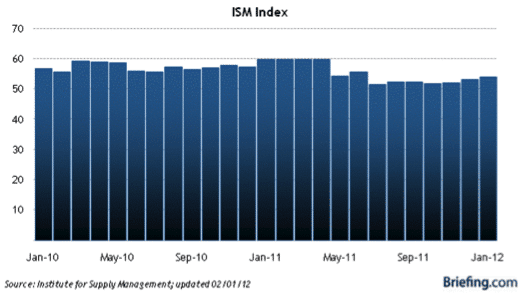

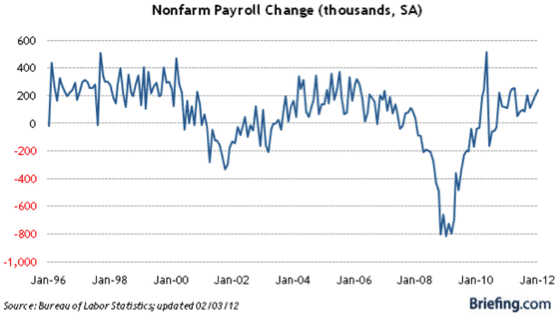

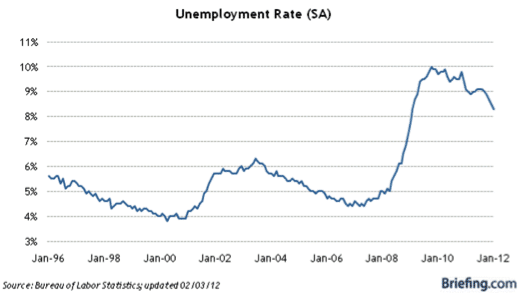

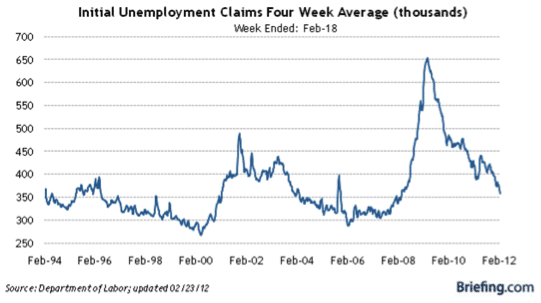

- This is supported by a recent slew of better than expected economic data: Initial claims, non-farm payrolls, ISM manufacturing index, GDP and consumer confidence among others have come in better than expectations (see attached charts at the bottom). Just today the initial unemployment claim data again came in better than expectations, therefore improving the odds that the Feb labor report in 2 weeks will be supportive.

- Market is shrugging off bad news like home sales in the US or slowdown in China manufacturing for the 4th straight month. This is a sign of the underlying cautiously bullish sentiment prevailing now. If the news starts to become predominately bad and economic data comes in worst, not better than expected, we could see a change in the current trend but that has not occurred as of today.

- The recently concluded earnings season was not bad, even though many companies were light on revenue compared to previous quarters. We also have many investors getting into the market later in this bull cycle and they are chasing prices higher.

- The major fear indicator CBOE Volatility Index for S&P500 (VIX) is breaking down well below the 20 mark, down 7% just today to close at16.80. VIX readings of 50 or higher denote panic, 30-35 denotes fear and anxiety, 20 denotes nervousness and below 20 denotes complacency. This could be used as a contrarian indicator for sure, but as of now fear seems to be leaving the market. Maybe we are getting used to headline risk and have confidence that policy makers will take steps to quell any fires that break out.

- Technical support for the SPX lies around 1270-1275. This level acted as support in March/June 2011 as well acted as resistance in October 2011. It is also the 50-day Simple Moving Average (SMA) on the SPX weekly charts. This represents a drop of roughly 7% from today’s close of 1363. A pullback to these levels, if it holds, will represent a buying opportunity in my book.

- Finally, the EU debt crisis seems to have calmed down and a new round of the ECB’s Long Term Refinancing Operations (LTRO) funding is coming next week. Greece got its bailout, which is still subject to parliaments all over Europe ratifying the recent agreements, but it gave us some relief in the short-term. Euro is rising against a basket of currencies (FXE) as some measure of confidence is restored in the markets. After the unprecedented liquidity from the ECB to EU banks for 3 year loans, the 10-year bond yields for nations have dropped below danger levels. Italy’s 10-year bond yield dropped from more than 7% (which is unsustainable) to 5.5% this week. Another round of this LTRO funding is coming on Feb 29 and is expected to be bigger than the last one in Dec, even though it may be the last one for a while. Banks are getting cheap money from the ECB that they are re-invest in government bonds which have higher yields.

All this adds up to a cautiously bullish short-term view of the market. I am positioned with a bullish bias in my portfolio today. If things start to deteriorate, I am in a position to use options to start adding more hedges to my portfolio. Live long and prosper, see you in the next blog post!

Charan Singh

OptionsANIMAL Instructor

Options Trading Resources

practice options trading * online options education trading * option trading school * trading options courses * online trading education * options trading class