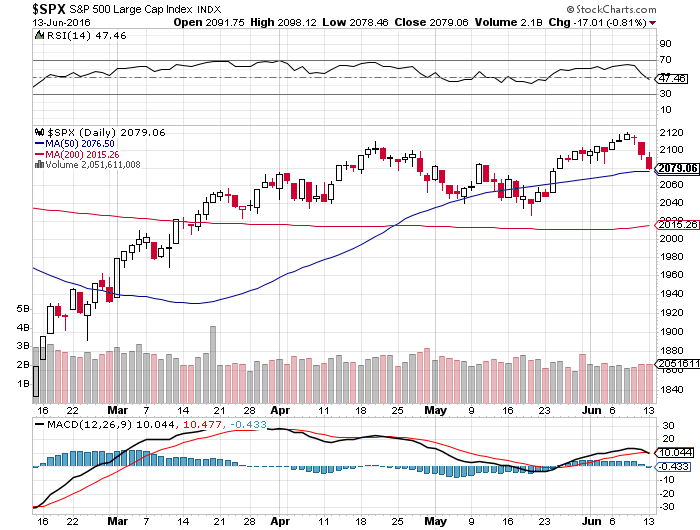

For the past three months, the major market indices have tended to trade within a relatively tight range. This has made it difficult for traders to find stocks that are presenting any significant directionality. Take a look at the chart of the S&P 500 below:

Notice that a significant level of resistance seems to have developed around 2120. You will also see that there tends to be a fairly solid level of support at about the 2040 range. So how does one go about trading this sideways zone with an awareness that it could suddenly end and take a significant leg up or down?

Most individuals who trade with options tend to favor the iron condor for such situations. The iron condor could quite easily be set up with the short calls above 2140 and the short puts below 2020. The iron condor is a relatively easy trade to place and maintain as long as the equity remains range bound. The trade produces a nice credit which the trader hopes to maintain throughout the trade. This is the most that the trade can ever make. Depending upon the net credit and the difference in strike prices, the risk to reward ratio can be very high. Another significant consideration is what happens when the equity suddenly takes on directionality? Most traders (who do not know how to make adjustments to an existing trade so that it would optimize the new trend) are forced to close the trade, quite often at a loss.

Wouldn’t it be better to initiate a trade that takes advantage of the same stagnant trend but has the capability to profit significantly if the underlying equity begins to trend again? Wouldn’t it make more sense to place a trade that can quite easily be adjusted from one that optimizes a stagnant trend to one that optimizes a directional trend? It’s a rhetorical question of course. At OptionsANIMAL we teach many different trades. The trade that I am referring to is a calendar trade or a diagonal trade.

In a calendar or diagonal trade, you buy a long option with at least 90 days of time value and then you sell a short option of the same type but in a near-term expiration series. If the strike price of the long option is the same as the strike price of the short option, it is called a calendar. If the strike price of the short option is different than the strike price of the long option, then the trade is referred to as a diagonal.

Like an iron condor, calendars and diagonals both benefit in a stagnant trend from the passage of time. Options traders familiar with the Greeks refer to this as a Theta positive trade. Where calendars and diagonals truly differ from iron condors is when an equity begins to trend. While iron condors can be adjusted into a trade that optimizes a trend, it almost always requires additional risk in the form of additional capital. Not so with the calendar or diagonal.

Calendars and diagonals are extremely flexible. They can be initiated in many different structures. The long option can be placed out of the money, at the money, or even in the money. The placement of the short option can be at the same strike price as the long option, or it may be placed at a strike price above or below the strike price of the long option. In so doing, the short option then becomes an instrument that reduces the cost basis of your long option. If the equity begins to trend in any direction, the short option can quite easily be rolled to a different strike price and/or different expiration series. Normally, this is done for credit which reduces the overall risk in the trade. It also allows the trade to be adjusted so that it more closely optimizes the current direction of the underlying equity.

It is this flexibility in the structure of a calendar or diagonal that makes the trade so attractive. While it can benefit from the passage of time much like an iron condor, it really shines when the underlying equity takes on directionality. In this way it is able to adapt to the new trend whereas an iron condor cannot.

If you would like to learn more about calendars, diagonals, Iron Condor’s or any other trade, please contact [email protected].

Jeff McAllister

OptionsANIMAL VP of Education