My last post on the topic of dividends and options explored the terminology of dividends and common questions relating to options trading. In this post, we will understand step-by-step what exactly is meant by ‘possible dividend risk’ when trading options.

To illustrate the process, we will use a recent SPY trade that was influenced by dividends and resulted in a larger than planned loss. This discussion will serve as a practical application example as to what “possible dividend risk” means and how it can play out.

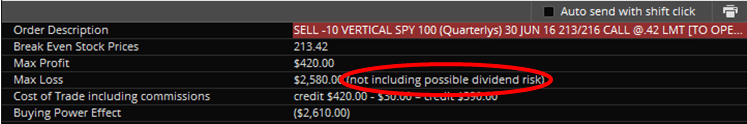

First, let’s take a look at this example of a Bear Call on SPY, one of the popular vertical credit spreads.

This SPY trade expires in 41 days on June 30th and will include an ex-dividend date on June 17th. The record date is June 21st. The dividend will be around $1.18 and be paid on June 29th.

This trade shows a potential profit of $420 and a maximum loss of $2,580. The Return on Risk is 16.3% in 41 days.

However, there is an additional potential risk in this trade due to the ex-dividend date falling within the duration of this position. This additional risk totals the $1.18 dividend x 1000 shares = $1,180 from owed dividends. This increased potential risk brings the total Return on Risk down to 11.2% from 16.3% earlier.

If you are assigned an exercise of the $213 Long Call (the counterparty to your Short Calls) before the ex-dividend date, you will be on hook to payout the dividend amount several weeks later on the payout date.

How can this additional dividend related risk play out?

Let’s walk through a recent trade on SPY. On Feb 29th I initiated a Bear Call for $0.25 credit or $125 in potential profit and $1,750 of maximum risk (not including possible dividend risk). If the trade played out as expected, I was looking to add more to this position. Unfortunately the trade did not play out as expected and the trade was ultimately closed for a loss.

Here is the starting position:

| SPY | Filled | 5 @0.25 | Sell 5 Mar-24-16 202/204 Call Vertical @.25 Limit | 02/29/2016 02:45:50 PM |

After the trade was placed the market went higher and the Short Call at $202 went in the money (ITM). The trade was still a few days to expiration and my plan was to make an adjustment prior to expiration. But on Mar 18th, the ex-dividend date, I received an Assignment notice from the broker. This was a week before the expiration and the SC was about $2 ITM. The five contracts of the Short Call at $202 (which were now deeper ITM and had less than $0.10 extrinsic value left) were assigned. Now I have 500 shares of SPY short along with the Long Call at $204 strike. The exercise of the LC $202 was actually assigned on Mar 17th and I was notified about it on the morning of the 18th.

Now I have a short stock -500 shares of SPY and my original $204 Long Calls:

| 03/18/16 07:32:49 |

Assignment | Sold 500 SPY @$202 | $2.27 | $4.95 | $100,992.78 |

I settled this short stock position by buying SPY at $204.60 and selling the Long Calls for a credit of $1.44 per share. This Long Call still had extrinsic value remaining which would have been lost had I elected to exercise early, therefore selling to close was the better option.

| 03/18/16 15:37:40 |

Trade | Sold 5 SPY Mar-24-16 204 call (SPYC2416C204000)@$1.44 | $0.23 | $7.45 | $712.32 |

| 03/18/16 15:13:00 |

Trade | Bought 400 SPY @$204.60 | $0.00 | $0.00 | $-81,840.00 |

| 03/18/16 15:13:00 |

Trade | Bought 100 SPY @$204.60 | $0.00 | $4.95 | $-20,464.95 |

Here is the math of the trade so far (excluding commissions of $30):

- Received Credit of $125 to start trade

- Received $101,000 from shorting 500 shares of SPY

- Paid $102,300 from buying shares of SPY

- Received $720 from selling Long Calls $204

Net Loss = +$125 + $101,000 – $102300 + $720 = -$455 or -$0.91 per share.

But, since I had short stock position PRIOR to the ex-dividend rate, I was responsible for the dividend of $1.049604 per share payable on April 29th. On 500 shares short, this amount comes out to $524.80. This was put in reserve by my broker on March 21st:

| 03/21/16 10:50:08 |

Reserve Out | RESERVE OUT $525 ON 03/21/2016 | $0.00 | $0.00 | $-525.00 |

The amount was finally paid out on Friday April 29th and showed up in my account on Sunday May 1st.

| 05/01/16 | Journal | SPDR S&P 500 ETF TRUST | $0.00 | $0.00 | $-524.80 |

So the total loss in this ill-fated Bear Call was not $455, but $979.80.

This example shows that dividend risk can be quite substantial and must be understood prior to initiating option strategies. In my next blog, we will explore another of the lesser understood but important topics…the process of option price and strike adjustment due to a special dividend.

Charan Singh

OptionsANIMAL Instructor