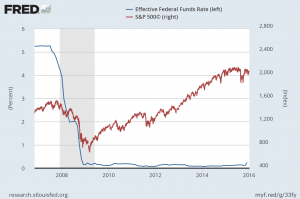

There has been no doubt that since March of 2009, the market has been in a consistent uptrend. This has been driven, in large part, by the Federal Open Market Committee’s quantitative easing (QE) through various mechanisms, including maintaining the Effective Federal Funds Rate at near zero – Zero Interest Rate Policy (ZIRP).

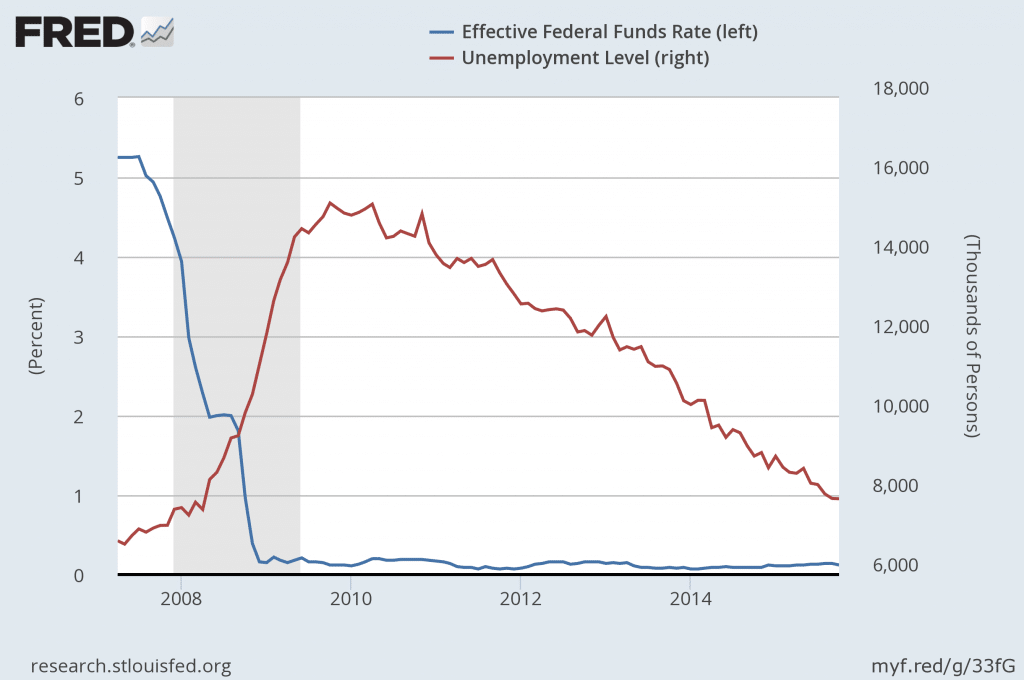

The Fed has a dual mandate of full employment and moderate inflation. The logic behind the lowering of the Fed Funds Rate is that it will spur business investment, creating new jobs and economic growth. This appears to have had the desired impact, as we have seen unemployment continue to fall throughout this period.

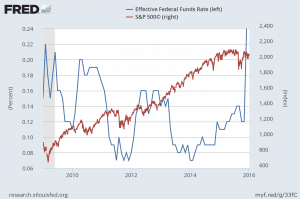

The Fed Funds Rate has not actually been zero. In fact, it has ranged from 0.07% to 0.21%. That is still very low, but it is not zero. Moreover, the market has appeared to like “free” money – or at least, close to “free” money. A comparison of the Fed Funds Rate and the S&P 500 shows that during this low-interest rate policy, there has been a continual uptrend.

However, during this period, there have been a few hiccups. It is hard to confirm which is causing which. Since ZIRP was initiated, the Fed has bumped up the rates, and the S&P continued to rise, then it would seem to snap and pull back. The Fed subsequently lowered rates and then the market eventually would turn bullish.

This increase in the market is due in part to the increased valuation of the market – through improved earnings. However, it is also the result of equities being the only game in town. Because of the ZIRP, bonds and other fixed income investments offer very little yield. Stocks are the only place where investors could hope to find a return. And since 2009, it has worked great! It is important to note that there were other things going on in the market at this time. It is not simply the Fed Funds Rate and the market… or is it that simple?

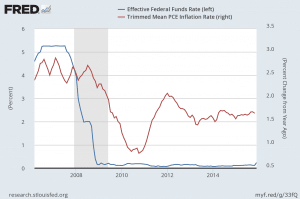

With regards to inflation, we have not seen the expected uptick. Yet, the Fed is forecasting inflation to rise in 2016. After reading the policy statements, I am not sure that I would agree with their consensus that the data points in that direction. In fact, when I read the policy statements, I feel like the word “hope” belongs in there somewhere. I think that the Fed is hoping inflation rises – because it is not in the data.

If things are as simple as they appear – that the reason for the bull market is the ZIRP, and the ZIRP is over – we should expect that a bearish market is upon us. Keep in mind that the market does not operate in a vacuum. There are many factors that drive the market. If we take a step back and look at some of the other factors, there are other significant indicators.

The US Dollar continues to strengthen against other major currencies. While this sounds patriotic, it is bad for our economy. It makes US products more expensive and supports the bearish case.

The crash in oil was a major theme in 2015. Currently, with Crude hovering around $35, we are at the lowest we have been in a decade – longer if you adjusted oil for inflation. The difference with oil prices today is that the price drop is a result of increased supply rather than a drop in demand. OPEC and shale oil supplies are exceeding the demand. Our economy literally runs on oil. It is used for car, truck, train, boat, and airplane fuel. Additionally, it is feedstock for manufacturing of plastics and other chemical products. The glut of oil should be a positive impact to our economy by putting more money in the consumers pocket and lowering the cost of shipping and manufacturing for businesses. The problem: we have not seen this impact. Consumers are saving and not spending more. The lower costs are not translating to improved earnings.

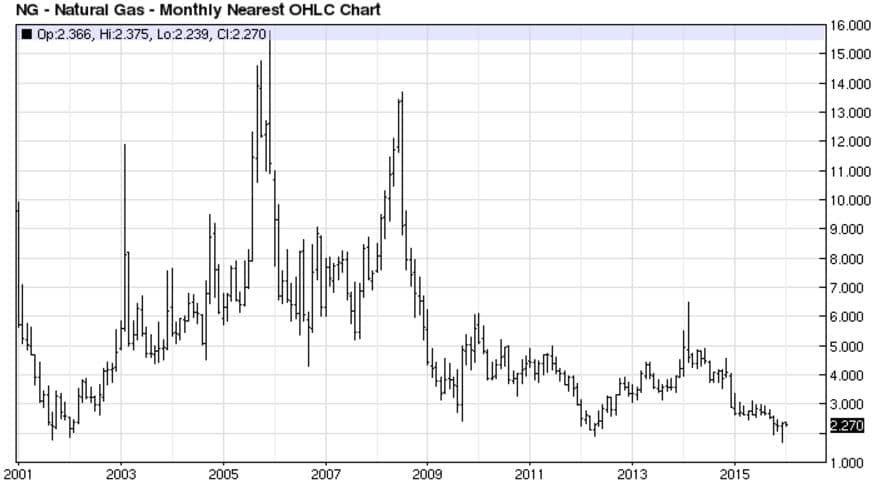

Along with low oil prices are low Natural Gas prices. Like crude, this has been a production story, too. Shale gas has changed the landscape of our energy footprint, especially for electricity. Natural gas is cheaper and more environmentally friendly than coal. The impact has been lower electricity, heating, and cooking prices, another benefit to consumers and businesses.

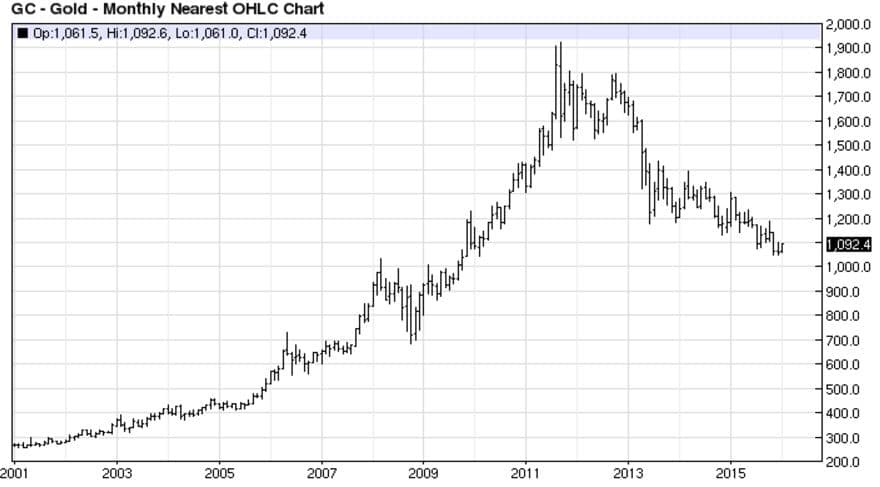

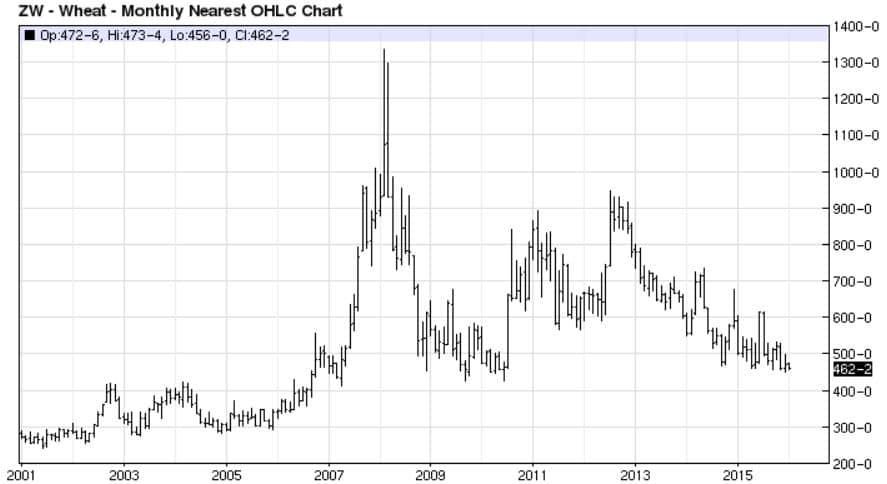

The drop in commodity prices has not been limited to energy. It has also dropped in nearly every commodity from gold to wheat.

What does all of this mean? The end of ZIRP is clearly a cause for concern. With increasing rates, safer fixed income assets will become more attractive, and investors will shift away from stocks as the yield increases. However, consumers with more money and their pocket and lower commodity prices are a formula for a robust growing economy.

On top of all of that, we have an election this year. Historically, presidential elections have had a profound impact on the market. Specifically, when there is a change in party, there is market upheaval.

Which side will the market head? It is difficult to say, there is too much uncertainty. And that is what the market really hates: uncertainty. Until we get some clarity, this spells for more volatility and probably a bearish trend until the end of the first quarter. Once the market has had a chance to digest the economic data; get through Q1 earnings, and more clarity on the presidential election a direction will be clearer. However, until then caution is prudent.

Eric Hale

OptionsANIMAL Instructor