When I think back in time, I realize that I only recognize the city, Cupertino, due to Apple, Inc. Looking on a map of California, I see that it is a suburb that is less than an hour outside of San Francisco. Not that I live anywhere close to San Francisco, but I am familiar with it nonetheless.

APPLE, Inc was created for investors (introduced as an IPO) in December 1980. If you’ve read the story about the creation of Apple, Inc., you probably know that it was a venture begun by Steve Jobs, Steve Wozniac, and Ronald Wayne in the late 1970’s. As their imagination expanded, they developed better items to represent the company. Steve Jobs had the appropriate charisma to persuade people to give the items a try, where all of those people remained loyal to these products as they became more stable and accepted. Steve Jobs became infected with a deteriorating illness, lost weight, and died in the fall of 2011. I wondered when the stock would take a big sell-off hit!

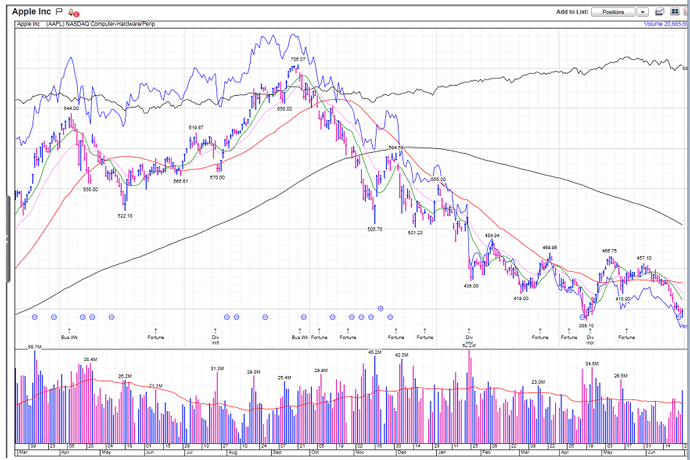

When we look at the price chart, we see that the sell-off occurred a year after Jobs had died. (This is a daily chart on 6.29.2013)

Apple, Inc. declined more than 45% from its peak at $705.07 in September 2012. The low price occurred on April 19, 2013. Anyone who recognized the bearish technical signals could have made some fine profit by shorting this equity! (Do you think of Bear Put Spreads or Put Calendar Trades using a diagonal? These are even permitted in an IRA!)

This week saw a great event that occurred at Apple, Inc. Timothy Cook (CEO) introduced the first new product since Steve Jobs’ death; the iWatch. The roll-out took place in Cupertino, CA on Tuesday afternoon. Although there was high uncertainty, many investors saw this as a special opportunity.

A conservative trading strategy would be a Covered Call (CC) on Apple, Inc. There are two instruments used: Long Stock (LS) plus Short Call (SC). The negative delta associated with the SC will modify the influence on the position during its “off days.” However, the SC also comes with a potential obligation to allow your stock to be called-away from you at the strike price chosen. (Don’t forget! The company pays a dividend, too!)

The course of action on this trade is to buy-the-equity and enter-the-short-call, too. The implied volatility on the options chain is quite low (mid twenties). Therefore, if the SC is in-the-money (ITM) at expiration (or the price of the equity is deep ITM before expiration) the stock will be called-away from the account. The equity shares (being the primary instrument) are now priced at around $100.00. How much credit is being offered for the SC?

If I chose the October 105 SC, I would be given between $1.57 and $1.73 credit per share. [One contract means $157 to $173 of credit against the purchase of 100 shares of the LS.] The LS is now at $101.66. If I expect it to move up past $105.00 by October 18th, I might be able to gain a small ROI on the CC. The cost basis (CB) is between $99.93 and $100.09. That would generate somewhere around 5% return in one month! (But, the price must move up and over $105.00 by the expiration date!) If the price does NOT rise above $105.00, then you’ve got the long stock at a “discount” and can lower the CB again by entering another SC at another expiration date.

Many think that the percent net return at 5% per month is not very rewarding. It will not make you rich quickly, but if I could make 5% each month, I’d end up with an annual return of 30%! (Nothing wrong with that!)

When I think about Cupertino, CA, I also think about Wetumpka, AL. Have you ever heard of that city? It does not have a long-term famous product; but, it is within a reasonable distance from Montgomery, AL. Who knows? There may be something in the making from Wetumpka now!

Emilu Bailes

OptionsANIMAL Instructor