Many investors will not enter NAKED Short Puts (or Cash Secured) due to the level of risk in this trade or their inability to watch the stock market each day. What is the risk? Let’s go over an example to figure it out.

Myriad Genetics, Inc [MYGN] gave their quarterly earnings-per-share data after the close of the market on March 10, 2014. The closing price that day was $37.75.

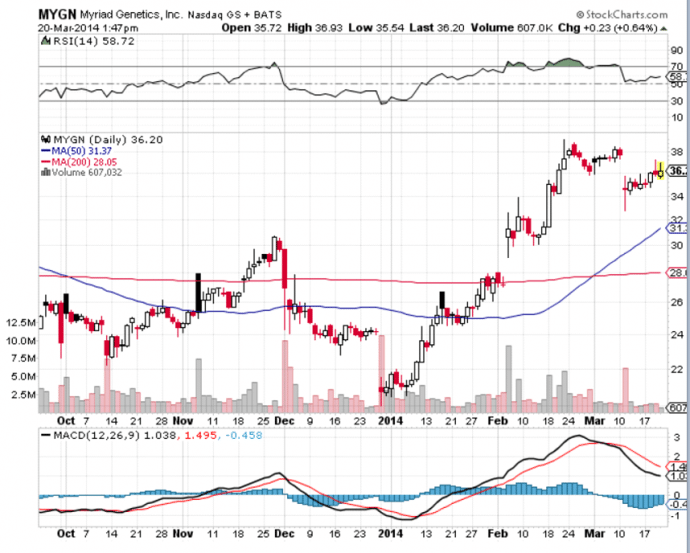

Where were the technical signals?

- The 5 and 20 EMAs were in a bullish pattern.

- The RSI was in an overbought position, slightly above 70.

- And the MACD had flashed a bearish trend change, where the MACD had fallen below the signal line a few days prior to the earning event.

When the US Market opened on the eleventh of March, the price dropped t $32.76 within the first ten minutes (13.21% price drop.) With that price behavior the implied volatility (IV) rose at the same time. There were only 12 days remaining in the March monthly options contracts. After watching this equity for the first thirty minutes, I could see that it was finding support at the level of $34.00. While watching the MYGN option chain, I saw that the strike 33 puts were offering a Bid of close to a dollar. Could I generate some income on this equity by selling the March 33 short puts? What would my risk be? I’d take in $1.00 per share with the obligation to buy the long stock at the price of $33.00. How would I calculate the risk? Take the buying price of $33.00, subtract the credit received of $1.00, and the remaining number of dollars was my risk – $32.00.

Is there any advantage in selling the short put on this stock? What would I need to know to feel comfortable entering a “naked short put?”

This is where I utilize my MarketSmith subscription to check on the fundamental data before entering the short put.

- What is the Composite Rating? 98 out of 99

- What is the ROE? 22%

- What is the debt? 0

- What is the EPS rating? 91 out of 99

- What is the SMR Rating? A

- Accumulation/Distribution Rating? A-

- Quarterly EPS Results? More than 20% for the last six quarters

- Quarterly Revenue Results? More than 20% for the last eight quarters

- Earnings Stability? 16 out of 99 (the lower, the better)

- Sector? Medical (number 5 out of 33 this week)

- Industry Group Rank? 9 out of 197 this week (Research Equipment/Services)

Why would I feel confident in entering the short-term, short put? As a member of OptionsANIMAL, I know how to monitor my trade and adjust it if the price drops down again. My choices are:

- Add protective puts on MYGN that will give me the Right-to-Sell MYGN at a certain price in a given period.

- Roll the short put out and down to keep it out of the money (for more credit)

- Prepare to turn MYGN into a Dynamic Collar trade once I take assignment of the long stock.

Having learned how to monitor and adjust my positions gives me the weapons I need to work with the stock market. Knowing how options behave, and how to generate reward from them, enables me to grow my account.

Although we are in a period of calm implied volatility, there are some events that raise the IV and give us some decent income each month, especially if we apply the full due diligence on the equity, and plan for managing our account wisely.

Emilu Bailes

OptionsANIMAL Instructor