From time to time, someone will ask me, “What is a covered put?”. I pause as I know that the following conversation pertains to a little used and often misunderstood strategy. A strategy that has a potentially unlimited risk. A strategy that can be used with a bearish outlook and one that can be structured with some minor adjustments to significantly reduce the risk.

Before I start to describe the covered put, I’d like to remind you that options provide an almost unlimited number of possible configurations. With many expirations, numerous strikes, calls versus puts and shorts versus longs, the only limit on what can be done with options is your understanding and your imagination.

So, what then is a covered put? It is a position where the investor shorts the underlying and then sells a put (one short put for each 100 shares of the equity).

What a covered put is not: There is some confusion with the terminology used in the world of options trading. A covered put is not a “cash-secured short (naked) put”. I have come across articles that treated a covered put (other terminology used to describe this strategy: covered put options strategy, covered put writing, covered put option) as if it were a cash-secured naked put.

It is not uncommon for an investor to use a naked put as an income generating strategy. The execution of the strategy simply has the investor selling a put option (typically) below the current price of the underlying. They receive a credit for the sale of the put. If the price of the equity remains at or above the strike price of the sold put option through expiration, the investor keeps the premium received initially. If the equity falls in price and is below the strike price of the option at expiration (or if assigned early as an American style option can be), then the investor would be obligated to buy the equity itself for a dollar value that is equal to the strike price of the sold put. Using this strategy, one typically has enough cash reserved in case this situation does occur. The logic of the strategy is based in the view that equity ownership at this price point (the strike of the short put) is desirable. I have my own thoughts on that, but I’ll save that for another blog…

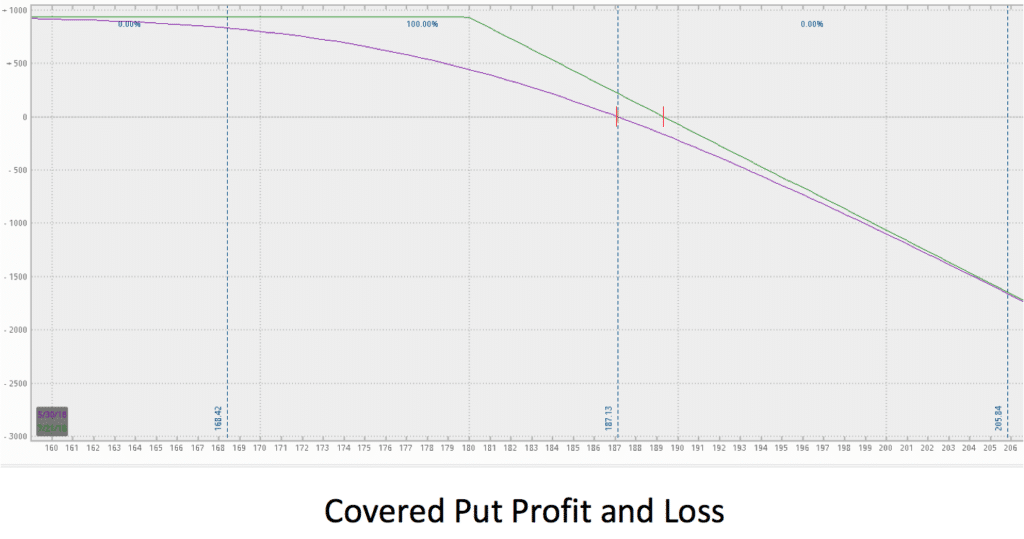

The most significant difference between a covered put and a cash-secured (or not) naked put is the risk. Take a look at the two profit and loss graphs below. The first is the covered put. Notice that the directional bias is stagnant to bearish. Because the short put obligates the seller of the put to buy the stock at the strike price of the put, thus flattening the short stock position, the return is limited. This limited return is the difference between the proceeds received from shorting both the stock and the put, and the strike price of the put.

If the stock becomes bullish, the short stock position becomes very risky as the short stock seller will have to buy the stock at a higher price than they sold it for. Since there is no theoretical limit to how high a stocks’ price could go, the risk is also theoretically unlimited. The sale of the put does offer a slight increase in the break-even price for the equity. That increase is limited to the cash received for the sold put itself. Therefore the theoretical break-even point can be calculated by adding the sale price of the stock to the premium received for the sale of the put. The risk is still infinite. We’ll discuss limiting the risk a bit later on…

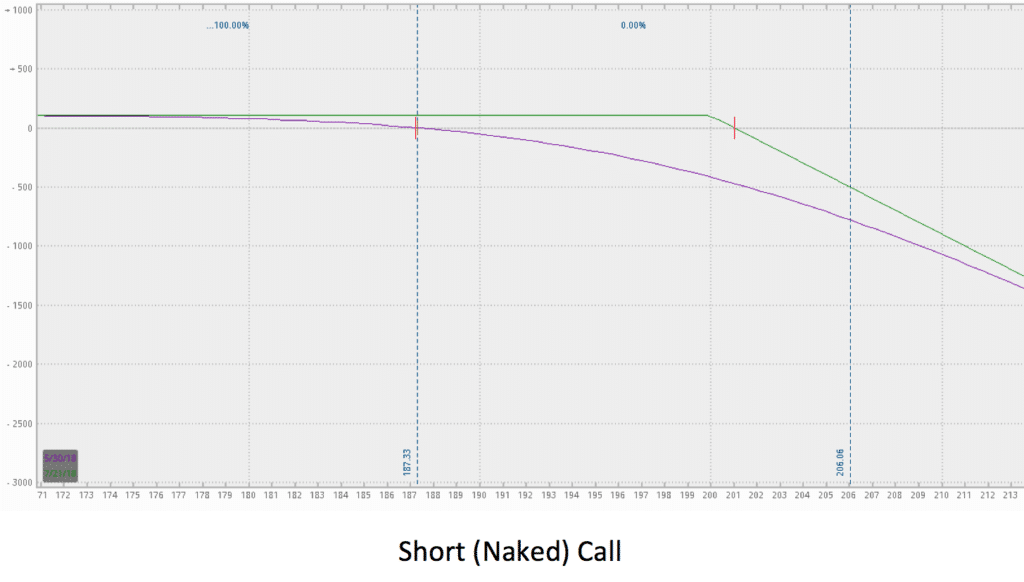

A short (or naked) call has the same risk profile and some would consider them to be synthetically equal.

Unlike the covered put, the naked call has lower transaction costs. A covered put has the additional fees to short the stock and eventually buy back the stock to close the trade. The naked call only has the opening transaction fees.

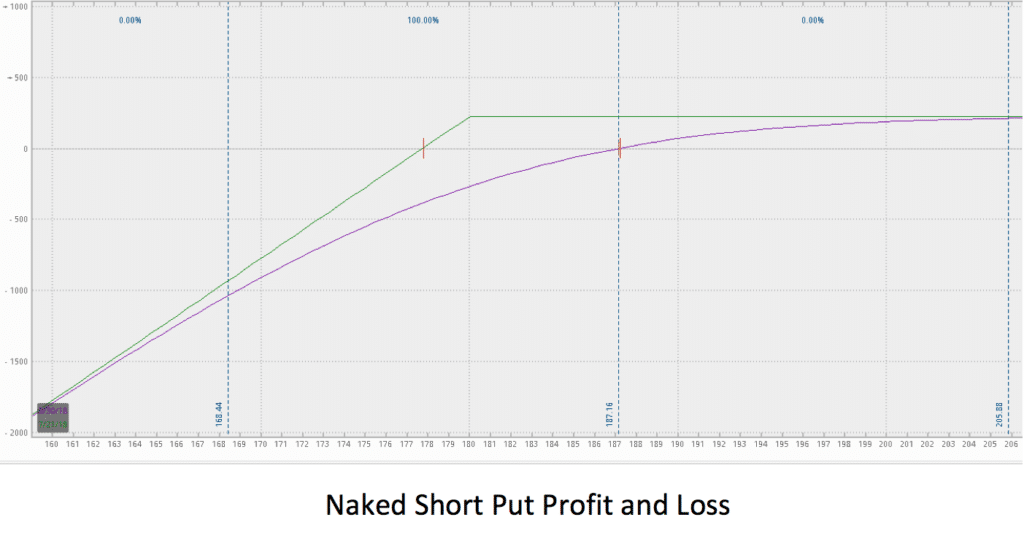

A naked (or cash secured) put on the other hand offers limited risk since the stocks’ price can only fall to zero. Take a look at the profit and loss graph below. The maximum return of the naked put is the premium received. To achieve this, the underlying equity simply needs to remain at or above the strike price of the short put. That implies that the equity can be bullish, stagnant or even slightly bearish and the writer of the put will make money. The risk is the strike price of the put minus what you were paid to sell the put. This is also the breakeven point for this trade, the strike of the short put minus the credit received. The risk is realized when the equity’s price falls below the strike price of the short put.

Both of the above strategies involve the sale of a put. The covered put also includes the short sale of the underlying equity. Both trades offer limited returns. The covered put has unlimited risk whereas the naked put does not.

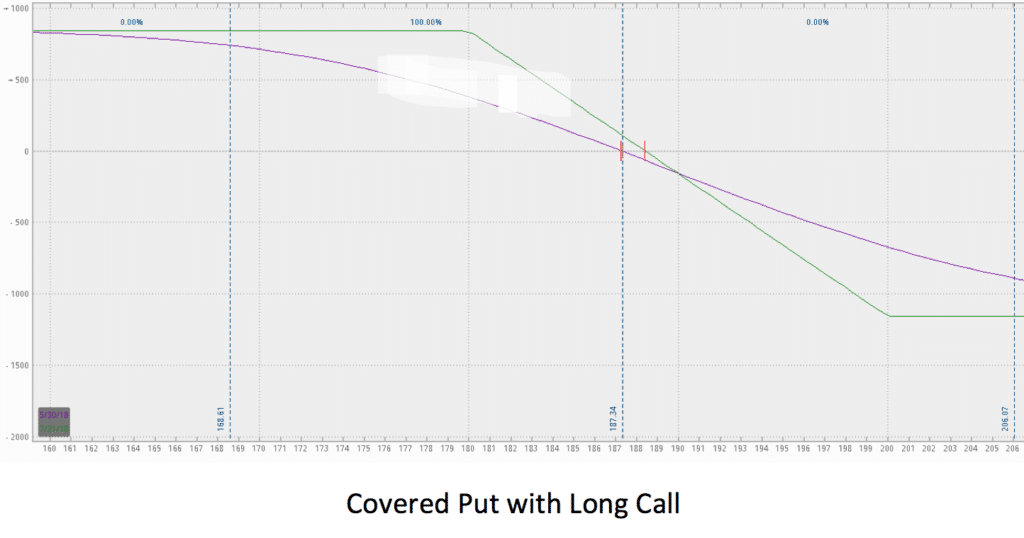

I mentioned earlier that there are ways to limit the risk of the covered put. A very simple approach would be to add a long call (one contract for each 100 shares of short stock). You would determine what amount of risk you are willing to take on the entire trade and then buy a call at a strike price that would cap your risk at that dollar value. How would this work? Let’s say that you do not wish to risk more than $2,000 on the trade. Divide that by 100 and then divide that by the number of contracts that you are considering for the trade. If you were planning on selling 200 shares and shorting 2 put contracts, the strike of the long call could be determined by the following example: (2000/100)/2 = 10. The long call would be purchased at a strike price that is $10 greater than the current price of the stock. This would add debit to the trade but it would also limit the amount of risk exposure that your portfolio would have. Take a look at the profit and loss graph below. It shows that by adding a long call to the covered put, you have limited the amount of loss that you could experience in the trade:

In summary, the covered put is a strategy meant to take advantage of a bearish trend. It has limited reward and unlimited risk (at least theoretically). In many ways, it is similar to a naked call in that they both have limited return and unlimited risk. The cash secured naked put seems to be a superior position in that it does not involve shorting the stock (something most retail traders are uncomfortable doing). Additionally, the unlimited risk of the covered put (as well as the naked call) compared to the limited risk of the naked put is another argument for one over the other.

As was pointed out, the risk element of the covered put can be reduced dramatically by buying long calls. In that way, the risk can be determined and controlled by the selection of which strike price to buy.

The covered put is just one of the nearly infinite trades available. What trade you choose to place must be a reflection of your expectations. At OptionsANIMAL we believe that expectation must come first and then the trader must match that expectation with the appropriate financial instruments. Additionally, we never enter a trade without first developing our plans for the original trade to go wrong. Remember, failing to plan is planning to fail…