Last Christmas, my wife and I received a full case of fresh Florida oranges as a gift from my parents. You can only eat so many delicious orbs of citrus goodness. With a dozen or so fresh oranges left, we broke out the juicer and squeezed them into a sweet decadent and pulpy nectar.

You have to love a good fresh squeeze.

However, fruit is not the only thing that gets squeezed. Sometimes stocks get squeezed, and the juice can be just as good. I am talking about Short Squeeze.

Today, when you think of short squeeze, Tesla Inc. (TSLA) is probably the name that comes to mind. And it should. As Elon Musk, Tesla’s CEO, a real-world Tony Stark points out frequently, it’s the most shorted stock in the market. Some people love to hate Tesla. Almost as many who love to love it. All you have to do is listen to the most recent shareholder call or read some of @elonmusk tweets to read his thoughts on “barnacles, flufferbots, and bonehead bears.”

To be honest, I am a huge fan of Elon Musk. He has put a dent in the universe, and he is not even done. He’s a modern-day Benjamin Franklin and will be honored in the pantheon of those who have made the world a better place. Personally, I have deposits on a Model 3, a PowerWall, and Tesla Roof. My Not-A-Flamethrower is paid for and will hopefully be in my hands not starting fires soon. I have been a shareholder in the past. Yes, I am an Elon Musk fanboy.

At the risk of getting on Elon’s bad side, let’s take a little time to consider the bear’s case. Bullet points to keep it simple:

Fundamental

- While quarterly revenues and earnings exceeded consensus, earnings per share are still negative, at a loss of $3.48.

- Tesla’s bonds are rated high-yield, a.k.a., “junk bonds.”

- Tesla has been struggling to meet its target on Model 3 shipments. Recently, Tesla announced a 9% layoff. While they say it is mostly white-collar positions, it is not clear how that is going to help the Model 3 production challenges.

Technical

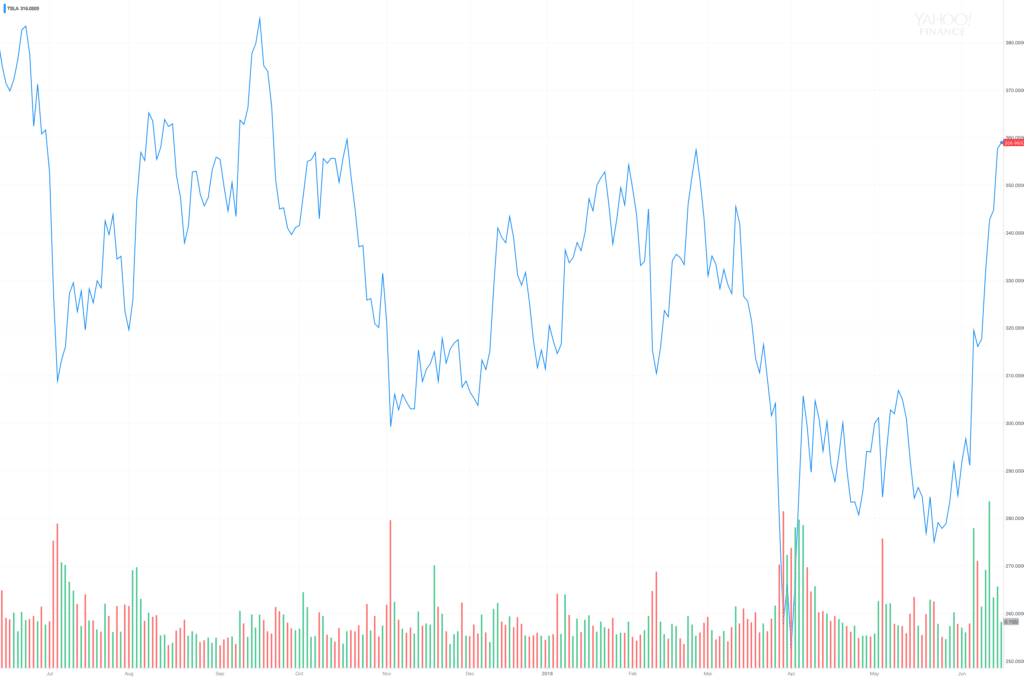

- Chart technicals had also been bearish until recently. TSLA hit a high of $389.61 in September 2017 and a low of $244.59 in April 2018. Until recently, the stock has been in a bearish channel.

[TSLA 1 YEAR Chart – Yahoo Finance]

[TSLA 1 YEAR Chart – Yahoo Finance]

- With the big move in early June 2018, the stock has been very bullish, pushing the Relative Strength Index (RSI) and Bollinger Bands to overbought level, which are contrarian, bearish signals.

Sentimental

- Investor sentiment can be measured objectively by considering the Implied Volatility (IV) index from a source such as iVolatility.com. IV index is neither bullish nor bearish but is a measurement of what sort of volatility is expected to happen in the future. The current TSLA IV Index Mean is 45%, which correlates to a daily move of about +/- 2.8% which is a significant level of intraday volatility.

[TSLA IV Chart – iVolatility]

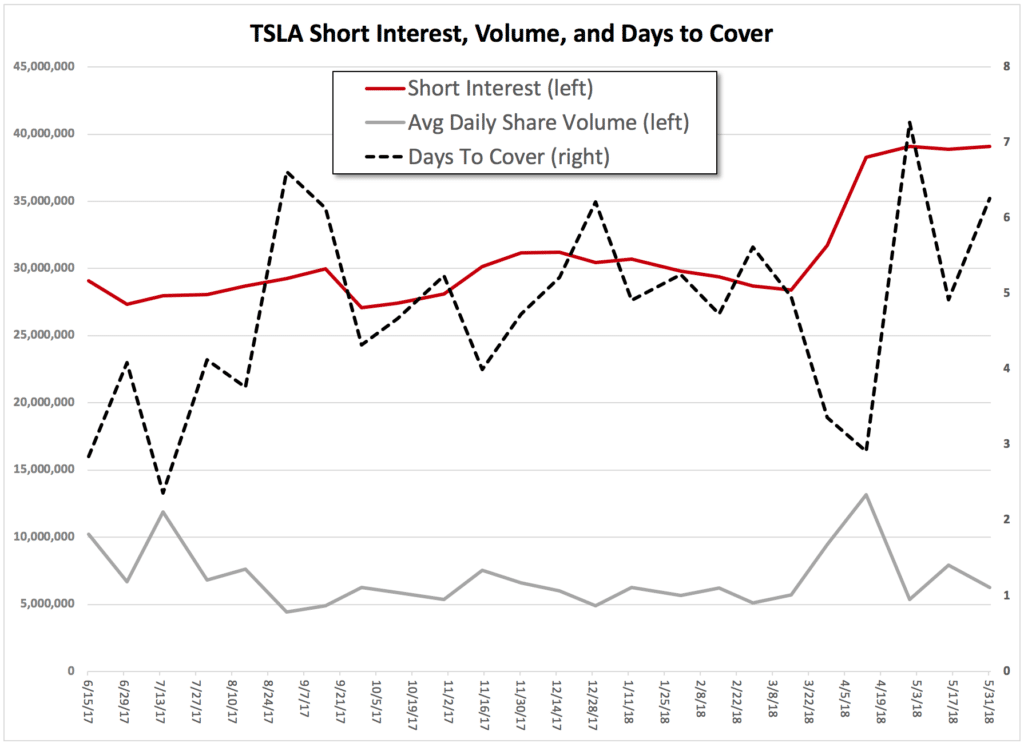

- Bearish sentiment can be directly measured by considering the short interest. These are shares that have been sold-to-open by traders with the intention of buying-to-close to cover them later, ostensibly at a lower stock price for a profit. The most recent short interest is 39 million shares.

[TSLA Short Interest]

It is the short interest that causes a short squeeze.

To consider if this short interest is significant it should be compared to something. We compare it to the total float, which is approximately 117 million. That puts the short float at 33.3% – one-third of all the TSLA shares – making it the most shorted stock in the market. Not a new story.

Another measure to consider the significance of the short interest is to look at the Days To Cover. This is simply the float divided by the averaged daily volume. What this literally represents is how many days it would take for all the short sellers to unwind their positions, if the short sellers were the only ones who were trading and volume did not change.

Now hold your horses! Before you freak out, in reality, that would never happen because there would be bullish long traders too. But the Days To Cover helps to keep things in perspective. Currently, the reading is at 6.3 days. In this high-frequency world, that is a very long time.

The picture that I painted above provides enough evidence to support the position of the bears. However, counter-intuitively, the short interest alone can be the very reason why the stock will be bullish.

Consider how the short squeeze works.

The market is merely a reflection of supply and demand. When traders sell, prices drop, and when traders buy, prices rise. Economics 101. Consider those short sellers. What do they need to do to close their positions? Buy 39 million shares of TSLA. How do you think that would affect the stock price?

Here’s how the short squeeze plays out bullishly:

- Bears sell-to-open stock (borrowed from shareholders.)

- In theory, the stock price eventually drops and short sellers buy-to-close to cover their positions. Buying makes the bearish trend ease.

- Other short sellers sense this slowing in the bearish trend and also decide to buy-to-close to cover their shorts and capture profits.

- Now, the stock stops the bearish trend and begins to rise.

- Some short sellers sense they missed the bottom so they also buy-to-close the stock to capture whatever profit they can.

- Now, a clear bullish trend ensues and short sellers begin to sweat.

- Technical and other bullish traders begin to see signals of this bullish trend and they jump on the bandwagon. To quote that guy on CNBC “BUY! BUY! BUY!”

- Short sellers buy-to-close to prevent turning that short position into a bigger loss. Keep in mind that short sellers have an infinite risk in the bullish direction.

- Now, with a solid upward swing underway, some short sellers see losses grow and do whatever they can to get out the stock. You got it, they buy-to-close and send the stock even higher.

- More bullish traders pile on and the short sellers who were holding out are now taking on big losses and the stock rallies higher. They capitulate and just buy to get out and end the pain.

Voilà! The classic short squeeze. So for traders who anticipate it, it can be a sweet, luxurious, and profitable nectar.

With the recent move in TSLA, short squeeze is definitely part of the explanation, and the squeeze is probably not over, which is good news for TSLA shareholders.

The short interest in TSLA increased by 10 million shares around the April lows of $244. With TSLA nearly one hundred dollars higher recently, that means there are a lot of short sellers feeling the pain, which is giving Elon Musk a reason to smile.

Where is TSLA going from here? It is anyone’s guess. The one thing that is for sure: TSLA will be volatile.